Wheat, akin to soybeans and corn, stands as a pivotal agricultural commodity in global food production, garnering significant interest in the commodities market. Investors are drawn to trade wheat, recognizing its vital role. While betting on wheat's future price entails risks, it also opens opportunities for substantial returns.

If you're contemplating investing in this agricultural commodity, it's notable that wheat trading is available on the eToro investment platform. For a comprehensive understanding, I encourage you to explore the detailed guide I've compiled. It includes not only essential information but also my personal insights, which could prove beneficial in navigating this intriguing investment avenue.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

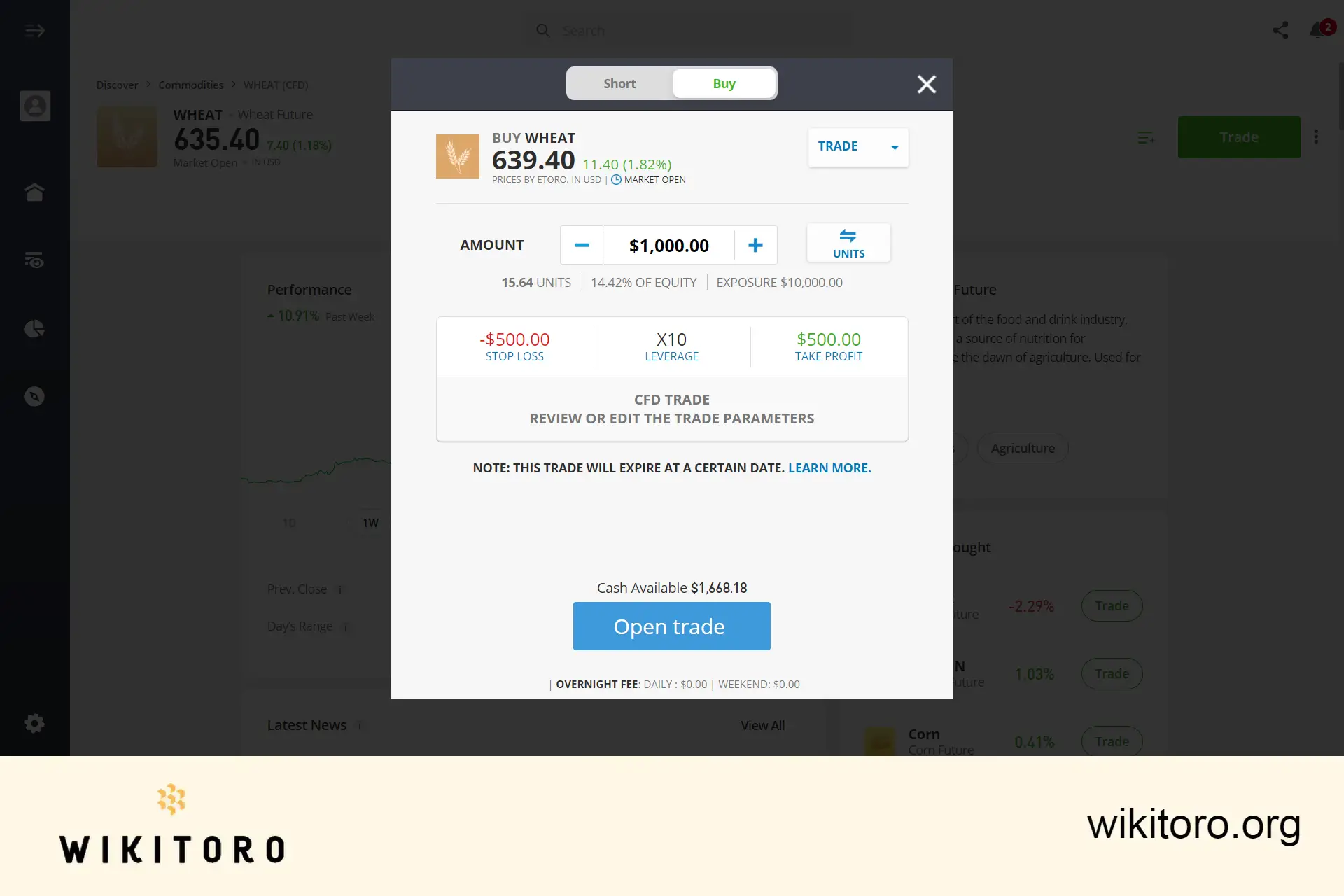

It's crucial to remember that trading wheat on eToro involves CFDs (Contracts for Difference), meaning you're speculating on price movements rather than owning the commodity outright. The allure of CFD trading lies in its ability to allow speculative trading on commodity market trends without the need for physical ownership or storage. Crypto CFDs/ Leverage trading is restricted for users under FCA.

Having traded wheat on eToro on multiple occasions, I've discerned numerous advantages. Some key benefits include:

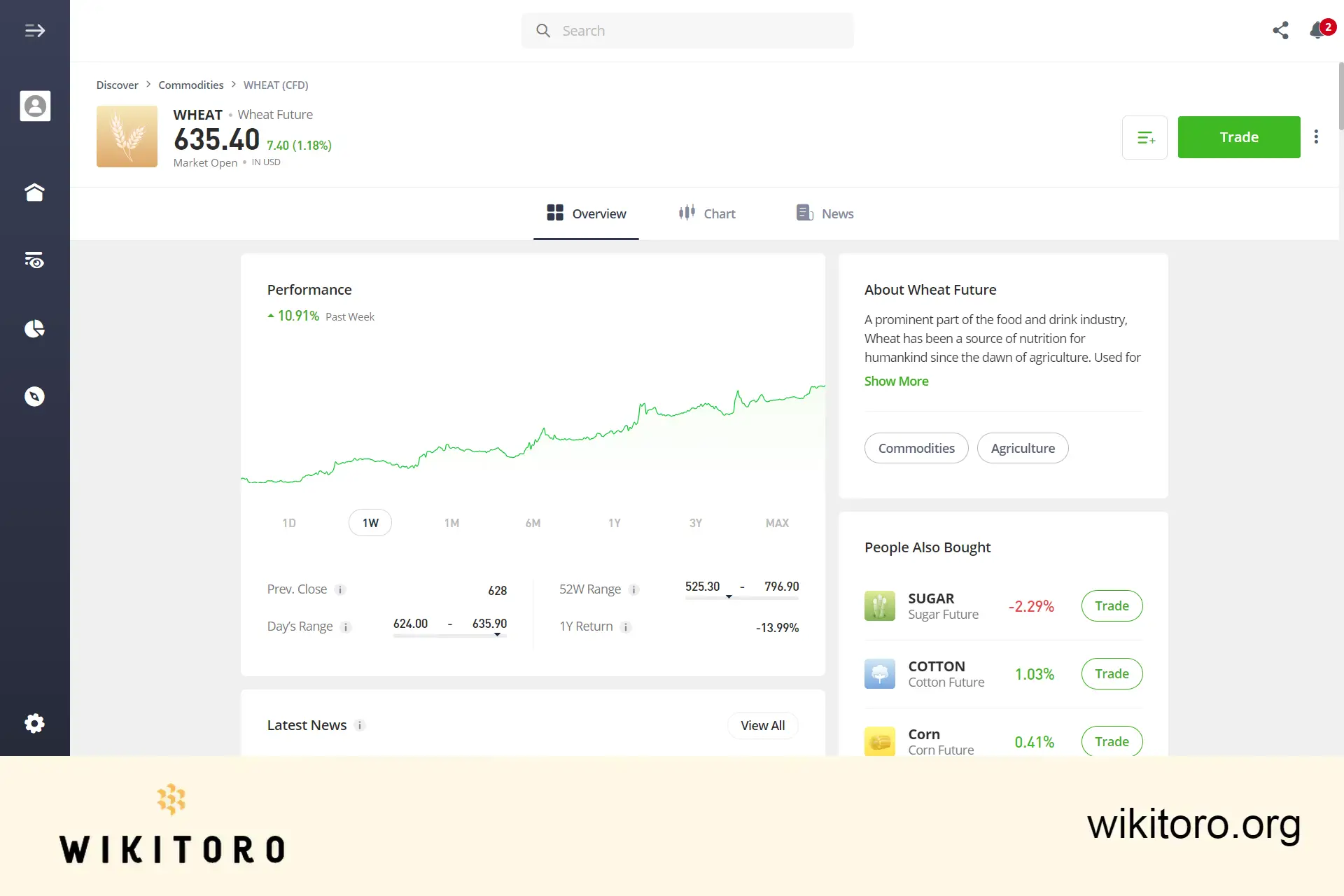

Upon accessing the wheat asset page on eToro, you'll initially land on the Overview section. This area showcases several key elements:

I've found several integrated tools on eToro particularly helpful for trading wheat:

To trade wheat, simply search for the asset, select "BUY" or "SELL," input your investment amount, set your trading preferences, and execute the trade.

That concludes the essentials of trading wheat on eToro, whether through their web-based platform or mobile app. Remember to utilize the tips shared here to enhance your online trading experience.

About Nadav Zelver

About Nadav Zelver