The US Dollar Index (DXY, USDX, USDOLLAR) is a crucial tool for traders aiming to assess the value of the US dollar against a basket of major currencies used by its trading partners. This index reflects the dollar's strength or weakness relative to six foreign currencies based on their exchange rates. A rising index indicates a strengthening US dollar, while a falling index suggests it's weakening. For those interested in trading this specific investment product, it's available on the eToro platform. This guide offers detailed insights and personal experiences on how to invest in this intriguing asset on eToro, so keep reading for valuable information.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

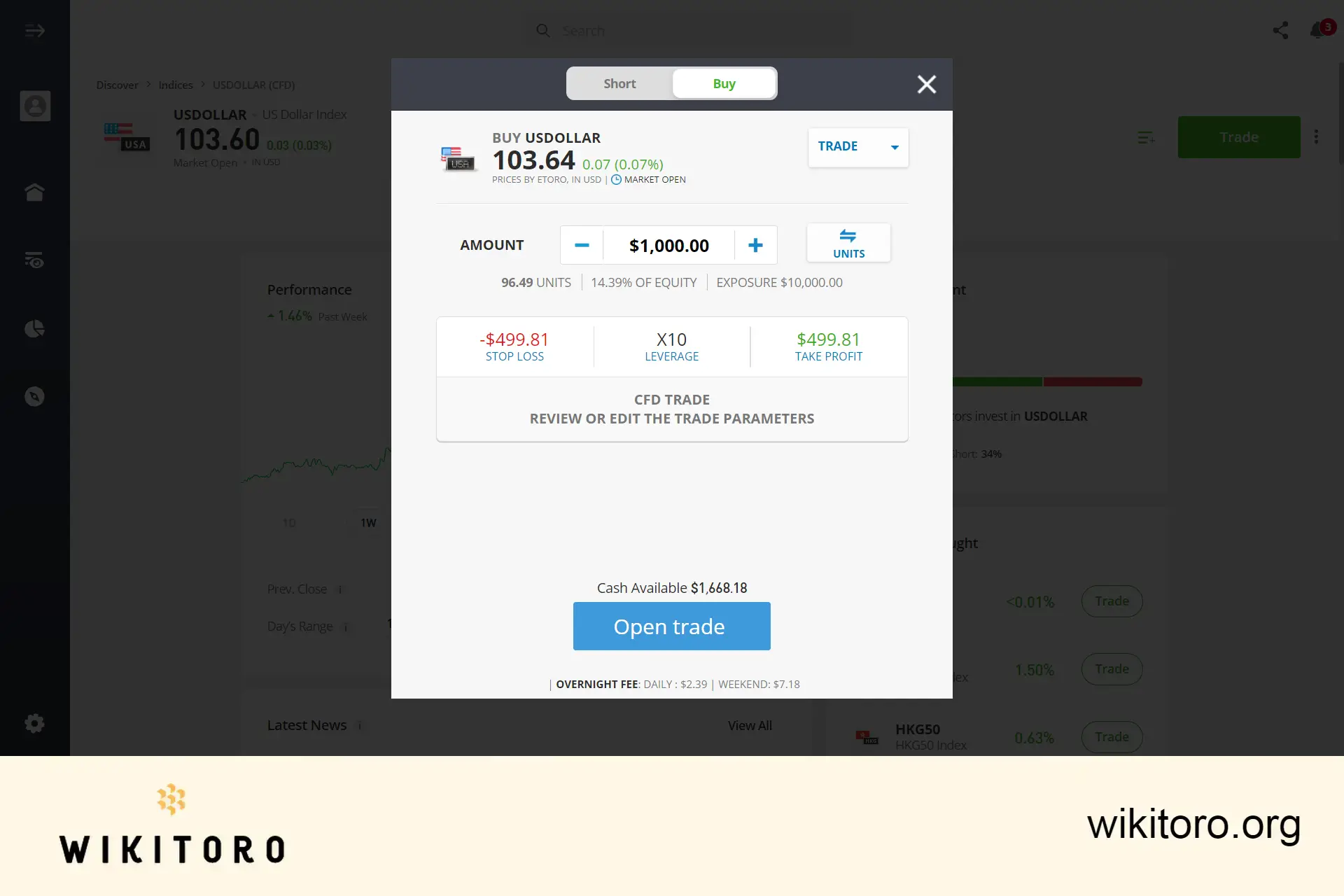

It's important to understand that trading the US Dollar Index on eToro involves CFDs (Contracts for Difference), not direct stock exchange trading. CFD trading is appealing due to its speculative nature on the indices market movements. CFDs allow traders to profit from price fluctuations without owning the underlying asset. The value of a CFD contract is based on the price difference between when the trade is entered and exited. With skillful execution, CFDs can yield a Return on Investment (ROI) regardless of market direction. Crypto CFDs/ Leverage trading is restricted for users under FCA.

Having traded this asset on eToro on multiple occasions, I've identified several key advantages:

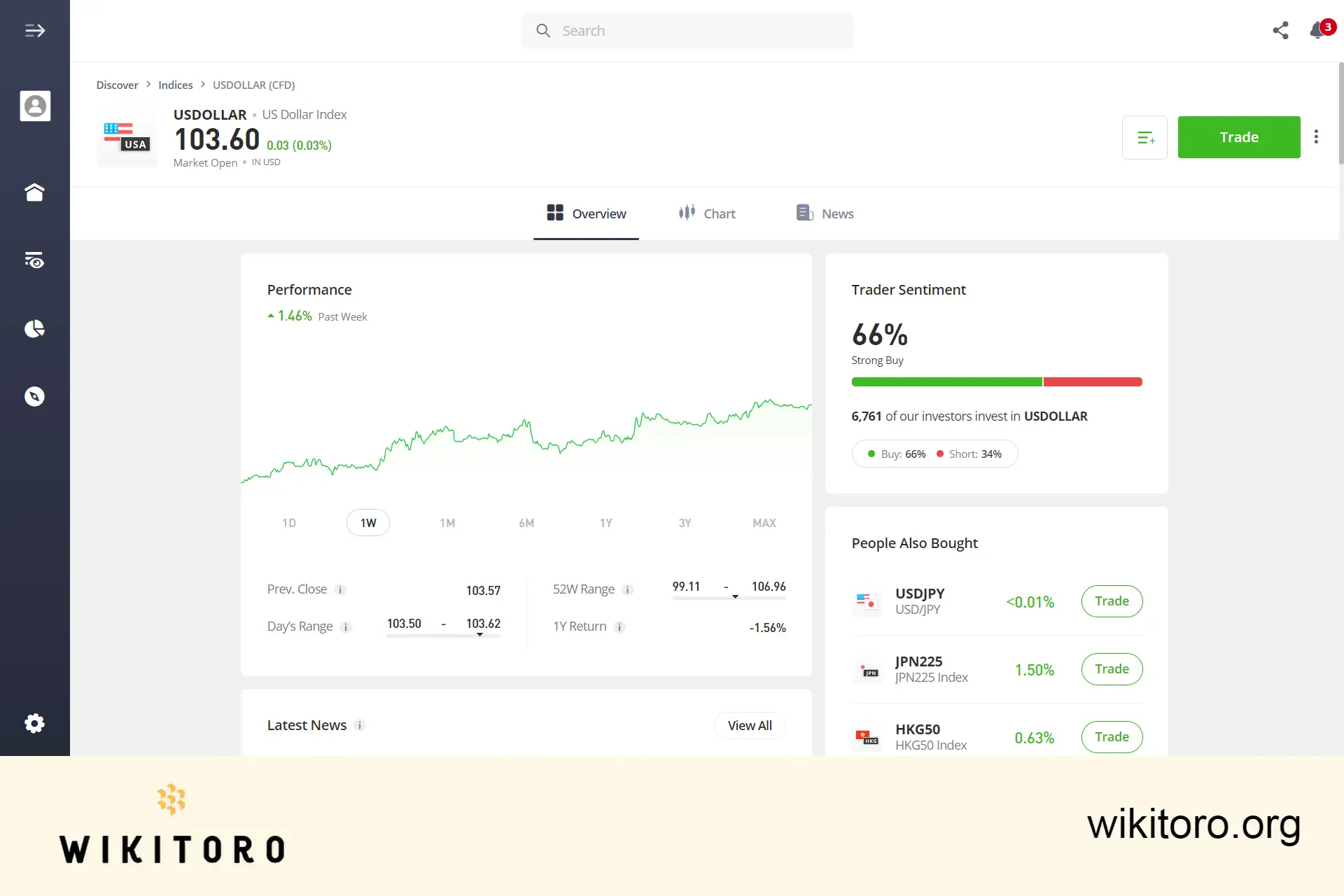

When you access the US Dollar asset page on eToro, you'll land on the Overview section, which serves as the default hub for several key features:

The integrated tools on eToro's platform streamline the trading experience, eliminating the need to switch between apps or screens. Notable tools include:

To trade this index on eToro, search for the underlying asset, select "BUY" or "SELL", input your investment amount, set your trading preferences, and execute the trade.

To effectively invest in the US Dollar index on eToro, it's crucial to understand the platform's features and tools. These insights apply to both the web-based platform and the mobile app. Remember to apply these tips judiciously in your trading activities and enjoy the comprehensive experience that eToro offers!

About Mike Druttman

About Mike Druttman