If you’re parking a sizeable balance with eToro, you want straight answers on how secure that cash really is. eToro operates under the watch of multiple regulators. In the UK, it’s overseen by the Financial Conduct Authority (FCA). In Europe, the Cyprus Securities and Exchange Commission (CySEC) keeps an eye on it. Down in Australia, it’s the Australian Securities and Investments Commission (ASIC).

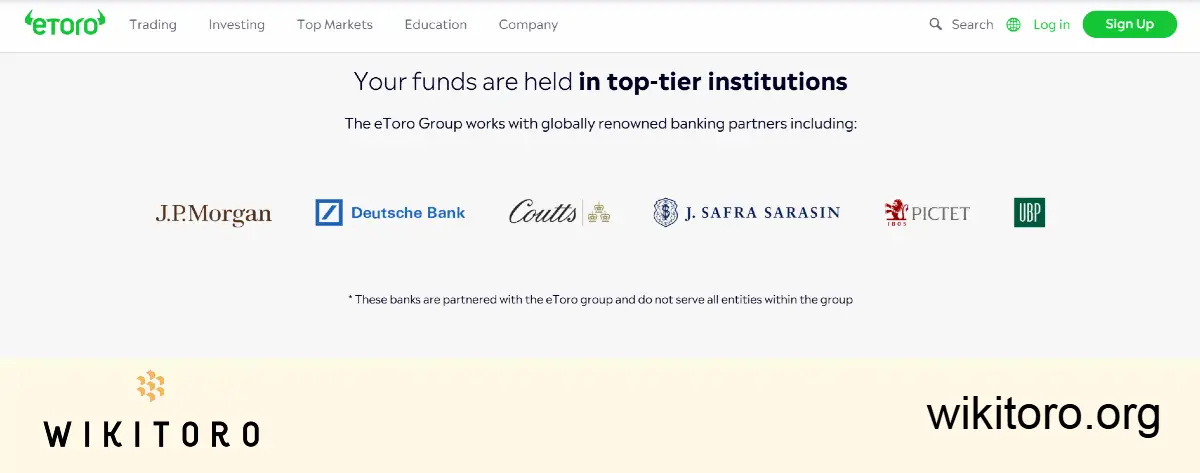

These regulators don’t take shortcuts. One important rule: eToro must separate client funds from its own accounts. So your deposits sit in ring-fenced accounts, kept away from company operations and debts.

There’s a backup layer too. Some investors qualify for national protection schemes. For instance, UK clients could be covered by the Financial Services Compensation Scheme (FSCS) up to a set limit if eToro ever went under.

On the technical front, eToro runs on bank-grade security, strong encryption, and layered systems that lock down your account against unwanted access. It also sticks to tight compliance checks to stay in line with global regulations.

Source: eToro.com - Investor protection at eToro

Still, no platform removes market risk. Big sums can drop in value fast if trades turn south. It’s worth thinking about how much you’re fine holding with one broker versus splitting your funds across different accounts or custodians for added peace of mind.

eToro’s track record is strong, backed by 40 million+ users worldwide. Its regulated status, account segregation, and investor compensation schemes add a layer of protection for storing larger amounts. Even so, I can't emphasize enough that risk comes with the territory. How you spread that risk can matter just as much as where you keep your account.

About Mike Druttman

About Mike Druttman