Nickel, a key industrial commodity since the 19th-century steel-making revolution, offers a solid investment opportunity. Its enduring high demand, coupled with a stable supply, makes it an attractive option for investors.

The interest in nickel has surged, especially following endorsements from industry leaders like Elon Musk, CEO of Tesla. Musk highlighted the critical role of nickel in manufacturing electric vehicles. This precious metal is not only in high demand but is also available for trading on platforms like eToro. For a detailed understanding, I've prepared a guide complete with my personal insights, which you may find valuable.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

It's important to note that trading nickel on such platforms involves dealing in CFDs (Contracts for Difference), not in the physical metal. The allure of CFD trading lies in its ability to speculate on commodity market movements without the need for physical ownership. Crypto CFDs/ Leverage trading is restricted for users under FCA.

Having traded this asset on eToro on several occasions, I've observed numerous benefits:

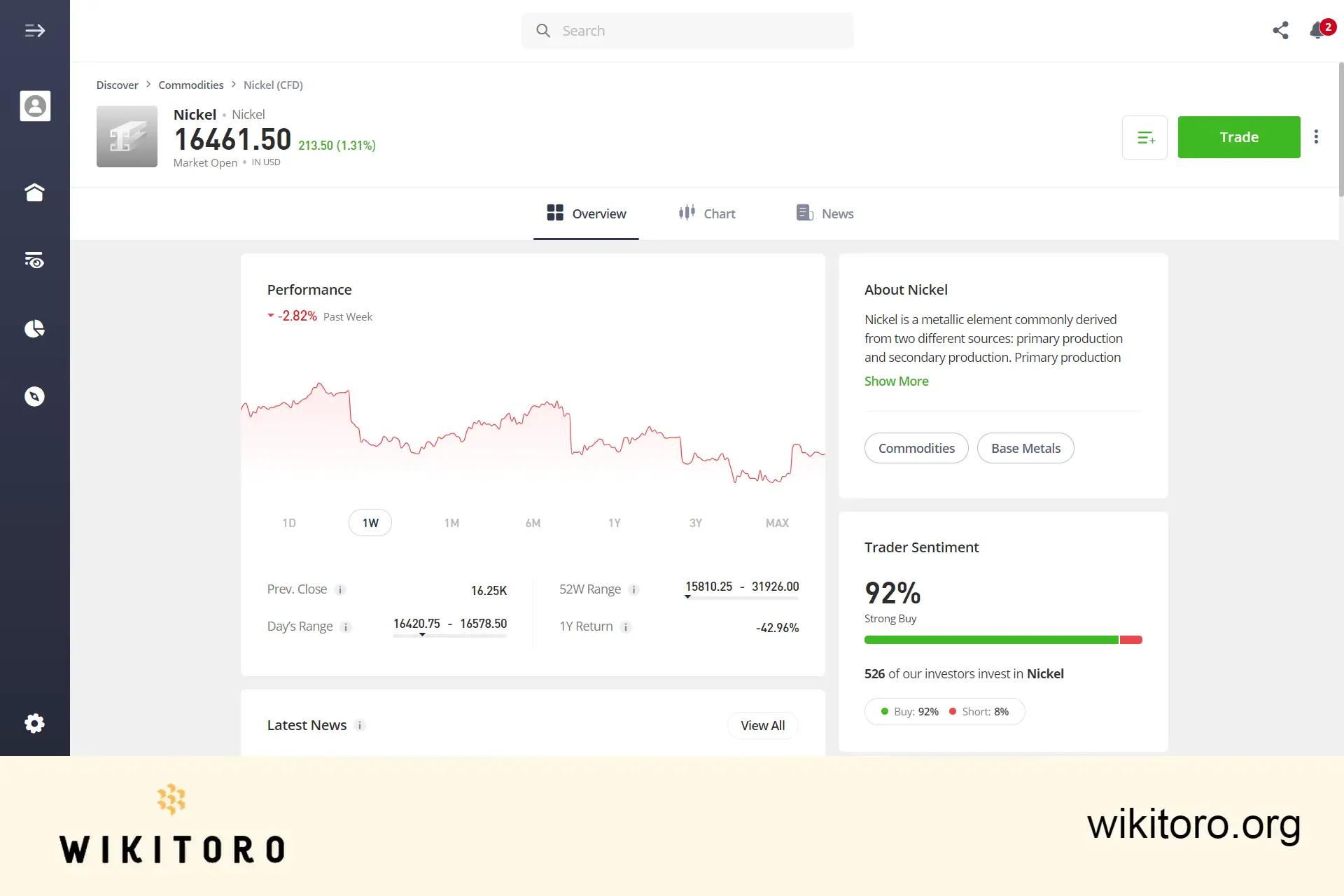

Upon accessing eToro's Nickel asset page, you'll land on the 'Overview' section, the default view offering several key elements:

The platform offers integrated tools that enhance the trading experience:

To start trading, search for the Nickel asset, select 'BUY' or 'SELL', enter your investment amount, set your trading preferences, and execute the trade.

That concludes the essential aspects of trading Nickel on eToro, whether using their web-based platform or mobile app. Keep these insights in mind to enhance your online trading experience.

About Nadav Zelver

About Nadav Zelver