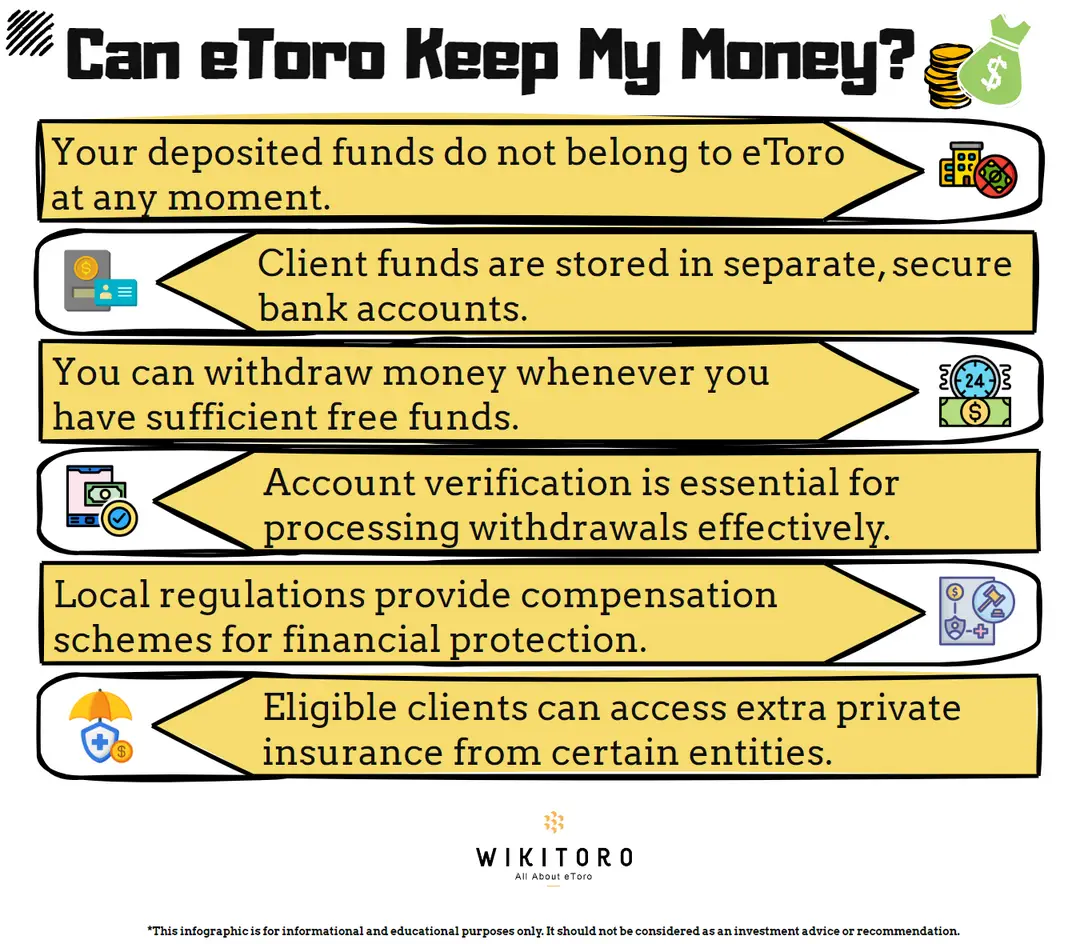

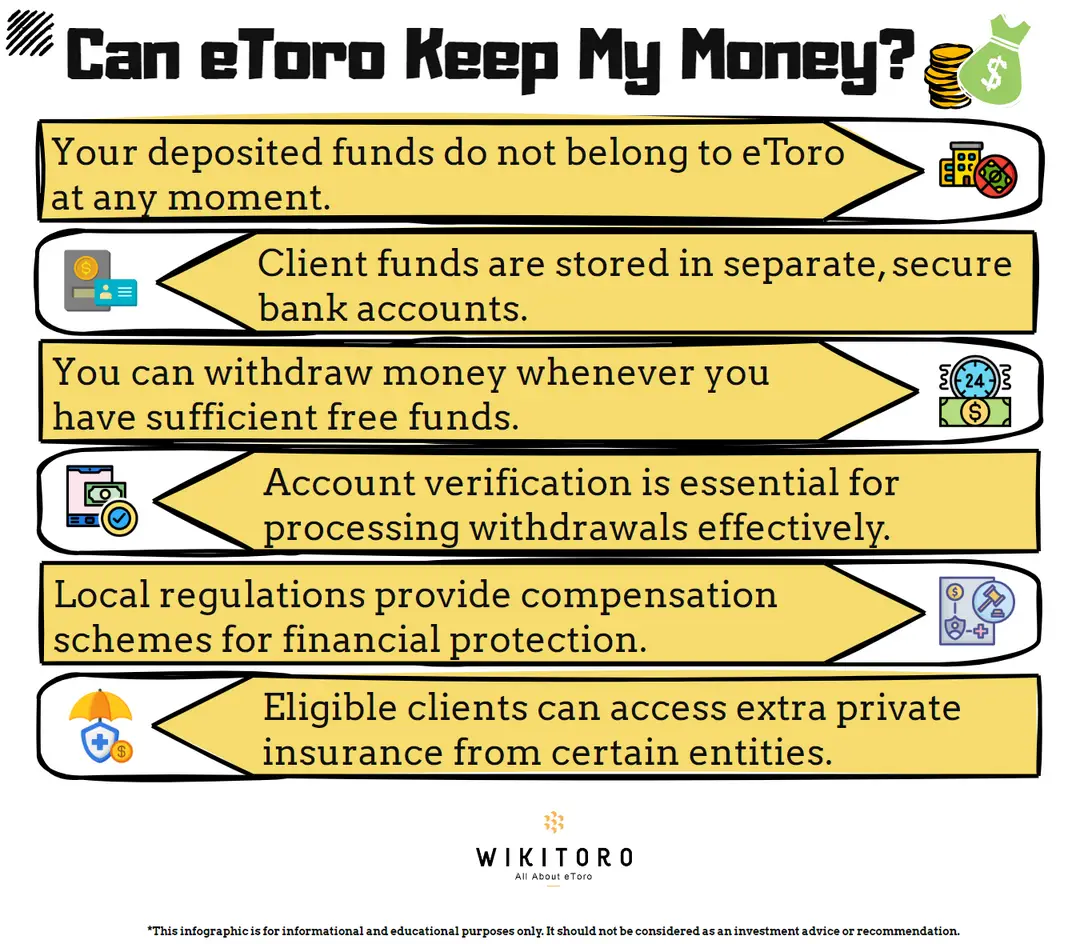

No. eToro can’t just hold onto your money and block you from accessing it. In normal conditions, your funds sit ready for withdrawal when you want them. Client deposits stay ring-fenced in separate accounts at leading banks. That means they never mix with eToro’s own operational cash. So even if the company hits a rough patch, your money can’t be grabbed to cover debts.

Your Money, Their Accounts Kept Apart

Any funds you deposit land in segregated accounts at trusted, regulated banks. That wall keeps your cash apart from company expenses. As a licensed broker, eToro has to stick to tight rules that protect client funds. Regulators in each region make sure of it.

But What Happens if eToro or the Bank Fails?

If eToro ever went under, investor protection schemes kick in. Exact coverage depends on where you live. Some countries/regions throw in extra private insurance too.

A few examples:

- UK (eToro UK Ltd): Covered up to £85,000 through the FSCS.

- Europe (eToro Europe Ltd): Up to €20,000 under CySEC’s Investor Compensation Fund.

- USA (eToro USA LLC): Up to $500,000 under SIPC, including $250,000 for cash.

- Australia (eToro AUS Capital): No set compensation fund, but ASIC regulations still apply.

In some cases, eToro backs this up with extra Lloyd’s of London cover for eligible clients. Up to € / £ / AUD 1 million per person (total group limit applies).

How Withdrawals Work

Your money stays yours. If your account’s verified and you have enough free funds after open trades and fees, you can withdraw at any time, straight back to your original payment method.

I always double-check the withdrawal rules and keep my account info current to avoid hold-ups. Just stick to normal trading and follow the platform’s terms because eToro won’t hold back your money.