Oil, a non-renewable resource, is a significant and volatile commodity due to its finite global supply and fluctuating demand. As oil prices rise, investing in this precious commodity can be a lucrative opportunity. eToro's trading platform offers the chance to trade oil, and I've prepared a detailed guide to help you navigate this. Additionally, I'll share personal insights that might prove beneficial.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

On eToro, trading in oil means dealing with Contracts for Difference (CFDs), not owning the physical commodity. The allure of CFD trading lies in its ability to speculate on market movements without the need for physical possession or storage of the commodity. Crypto CFDs/ Leverage trading is restricted for users under FCA.

Having traded oil on eToro on multiple occasions, I've observed several advantages:

Accessing the crude oil asset page on eToro directs you to the Overview section, which serves as a comprehensive hub. Here, you'll find several key elements:

What sets eToro apart are the integrated tools that enhance trading experience:

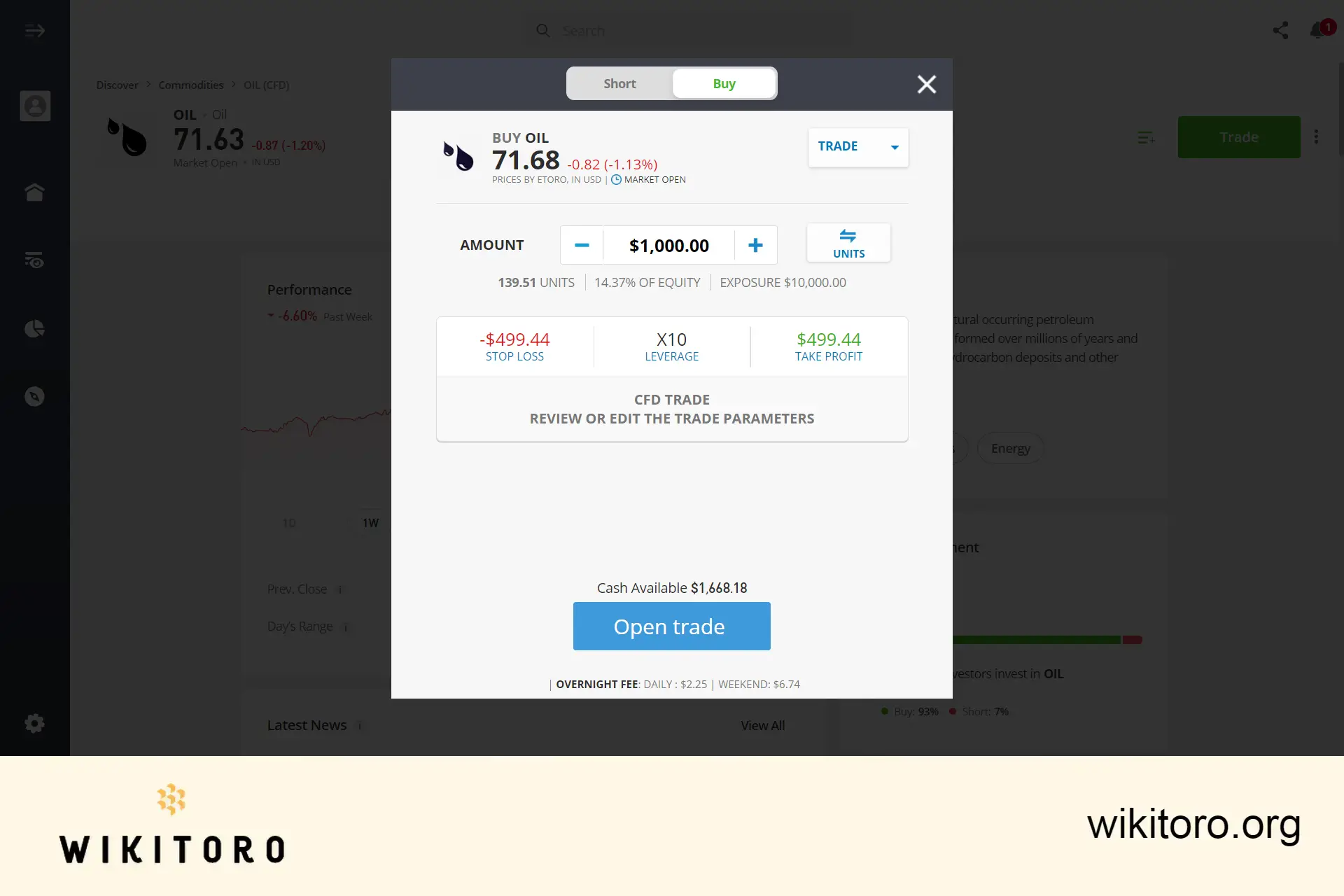

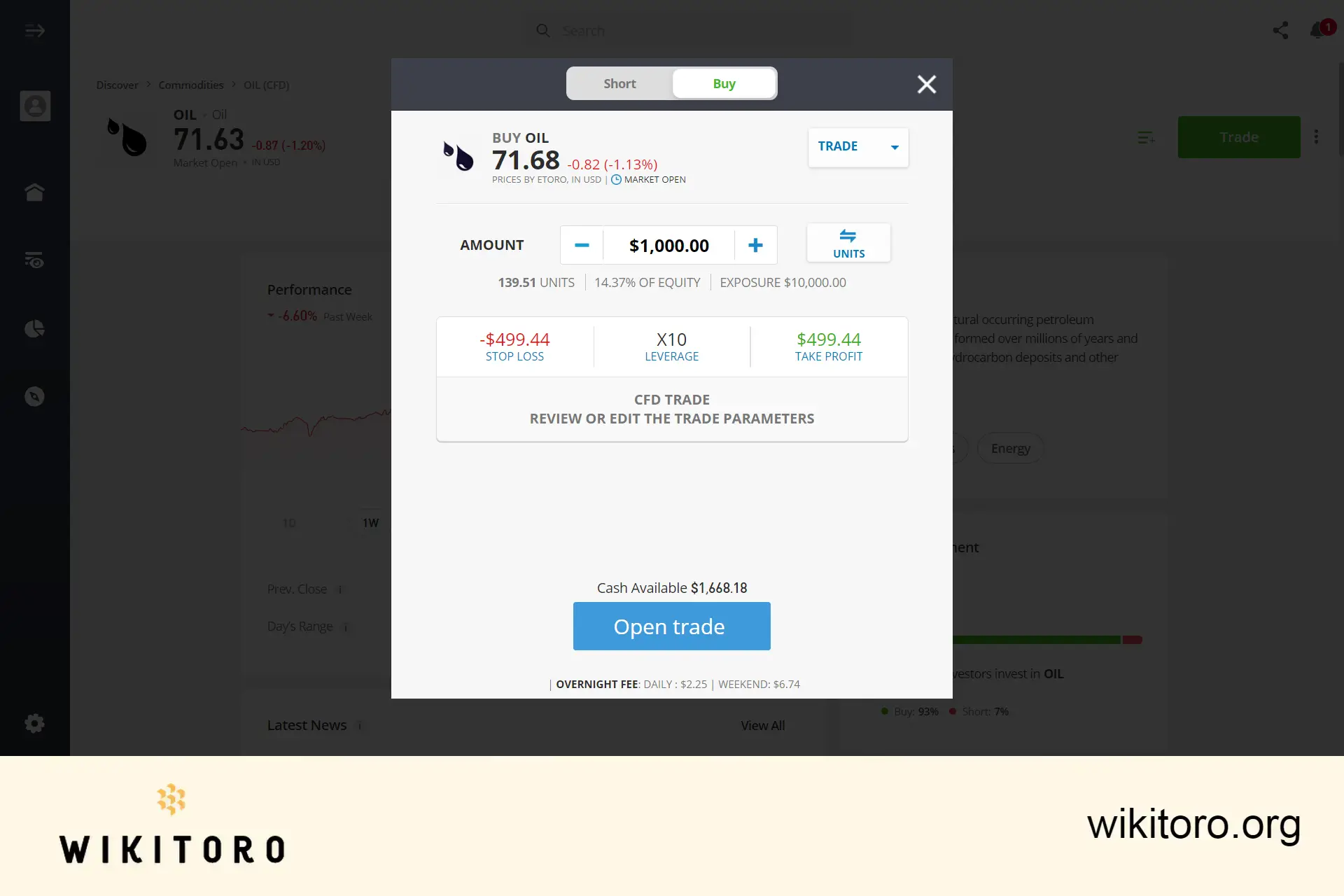

To trade, simply search for the crude oil asset, select "BUY" or "SELL", enter your investment amount, set your trade preferences, and execute the trade.

That's everything you need to know about trading crude oil on eToro, whether using the web platform or mobile app. Remember these insights and apply them strategically in your online trading journey.

About Mike Druttman

About Mike Druttman

Related Articles

We've compiled a list of related articles