Platinum, a rare and non-corrosive metal, maintains its high value despite a smaller market share compared to gold and silver. Its limited market does not lessen its appeal as a desirable investment option. With global economies increasingly favoring environmentally friendly materials, platinum's status as an eco-friendly metal boosts its demand. Its ease of mining and consistent supply, coupled with price volatility, suggest a significant potential increase in its value in the coming years.

Excitingly, platinum is also tradable on eToro's platform. For a comprehensive understanding and personal insights, I invite you to explore my detailed guide on the subject.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

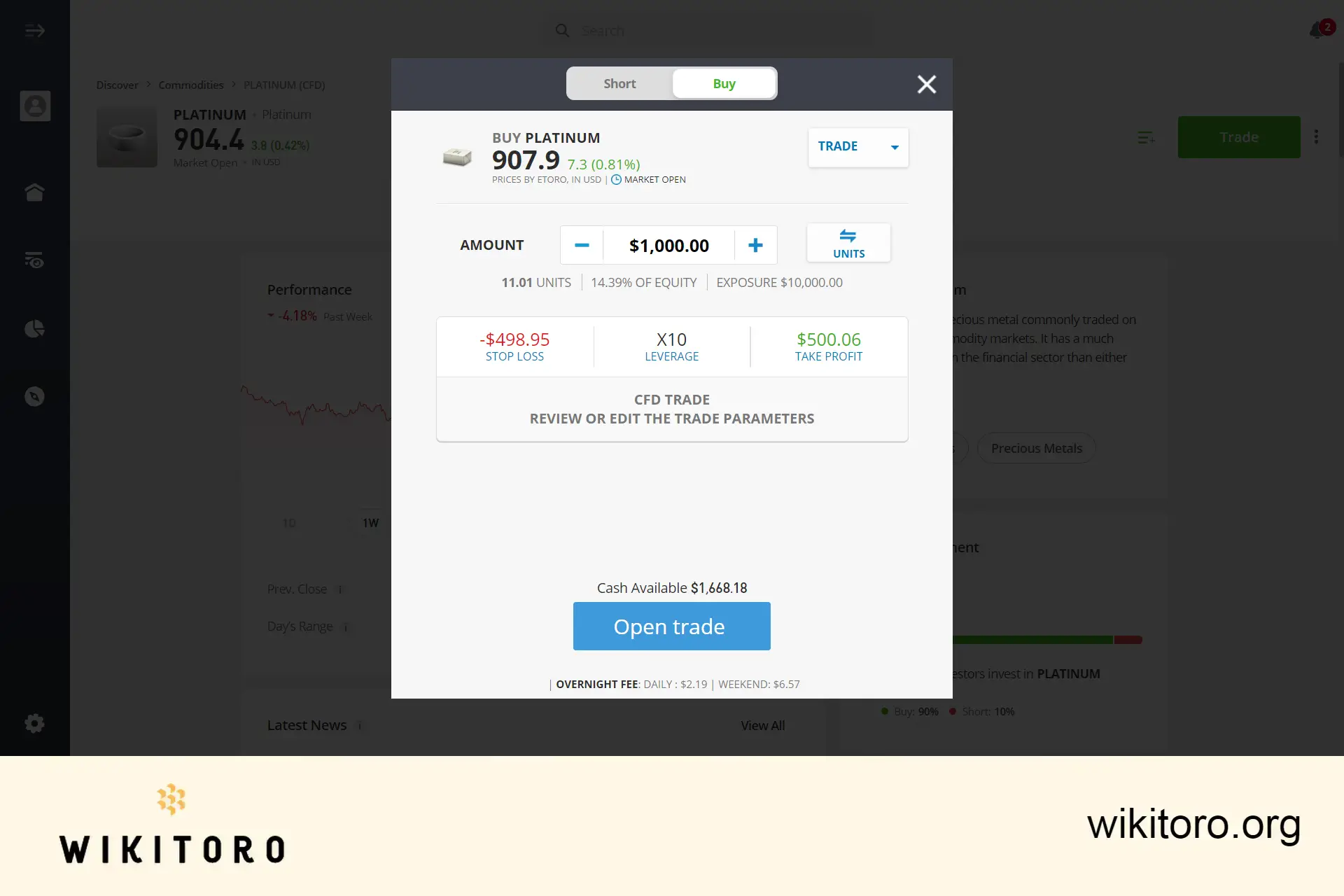

It's important to understand that trading platinum on eToro involves CFDs (Contracts for Difference), meaning you speculate on the price movement rather than owning the physical metal. CFD trading is appealing because it allows for speculative trading on commodity market movements without the need for physical ownership. Crypto CFDs/ Leverage trading is restricted for users under FCA.

Having traded platinum on this broker on several occasions, I've identified numerous advantages:

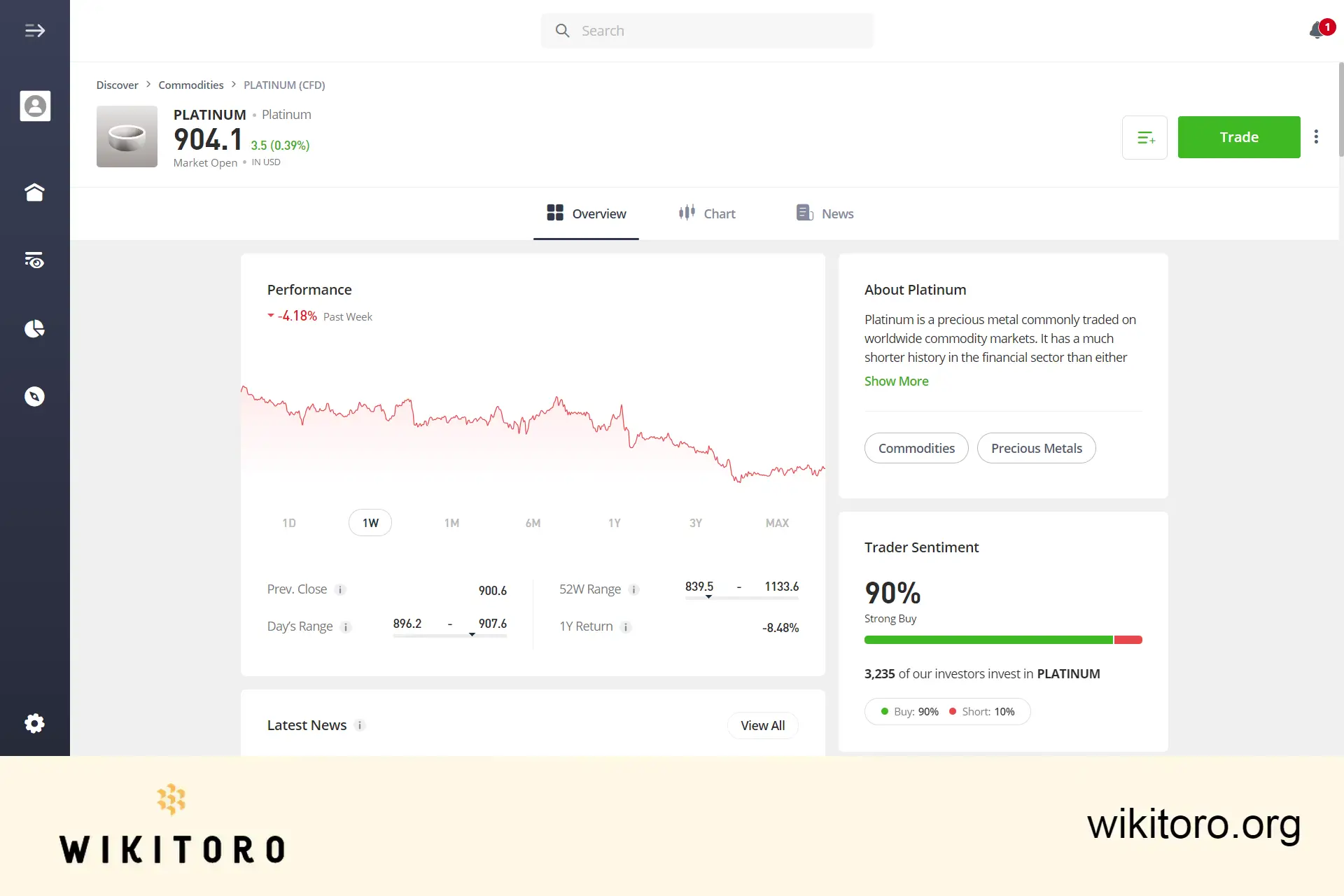

Upon accessing the Platinum asset page on eToro, you're greeted by the Overview section, which serves as the default landing area. This section includes several key elements:

eToro's integrated tools enhance the trading experience:

How to trade platinum on eToro? To do this, simply search for the asset, choose "BUY" or "SELL," enter your investment amount, set your trading preferences, and execute the trade.

That concludes your guide to trading Platinum on this broker, whether through the web platform or the mobile app. Remember these tips and apply them strategically in your online trading journey.

About Nadav Zelver

About Nadav Zelver