The US Dollar (USD) and Swiss Franc (CHF) pairing, commonly referred to as the "Swissie," is a magnet for experienced traders. Switzerland's consistent economic and political stability contributes to this allure. Bridging two of the world's economic powerhouses, the USD/CHF is a heavyweight in the forex market, accounting for about 5% of annual forex transactions.

This currency pair is favored for its role as a safe haven, maintaining high liquidity even in turbulent economic times. Its sensitivity to economic and geopolitical events lends it a degree of predictability, appealing to traders. An added bonus is its availability on eToro's forex trading platform. For detailed insights and personal experiences with this pair, be sure to consult my comprehensive guide.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

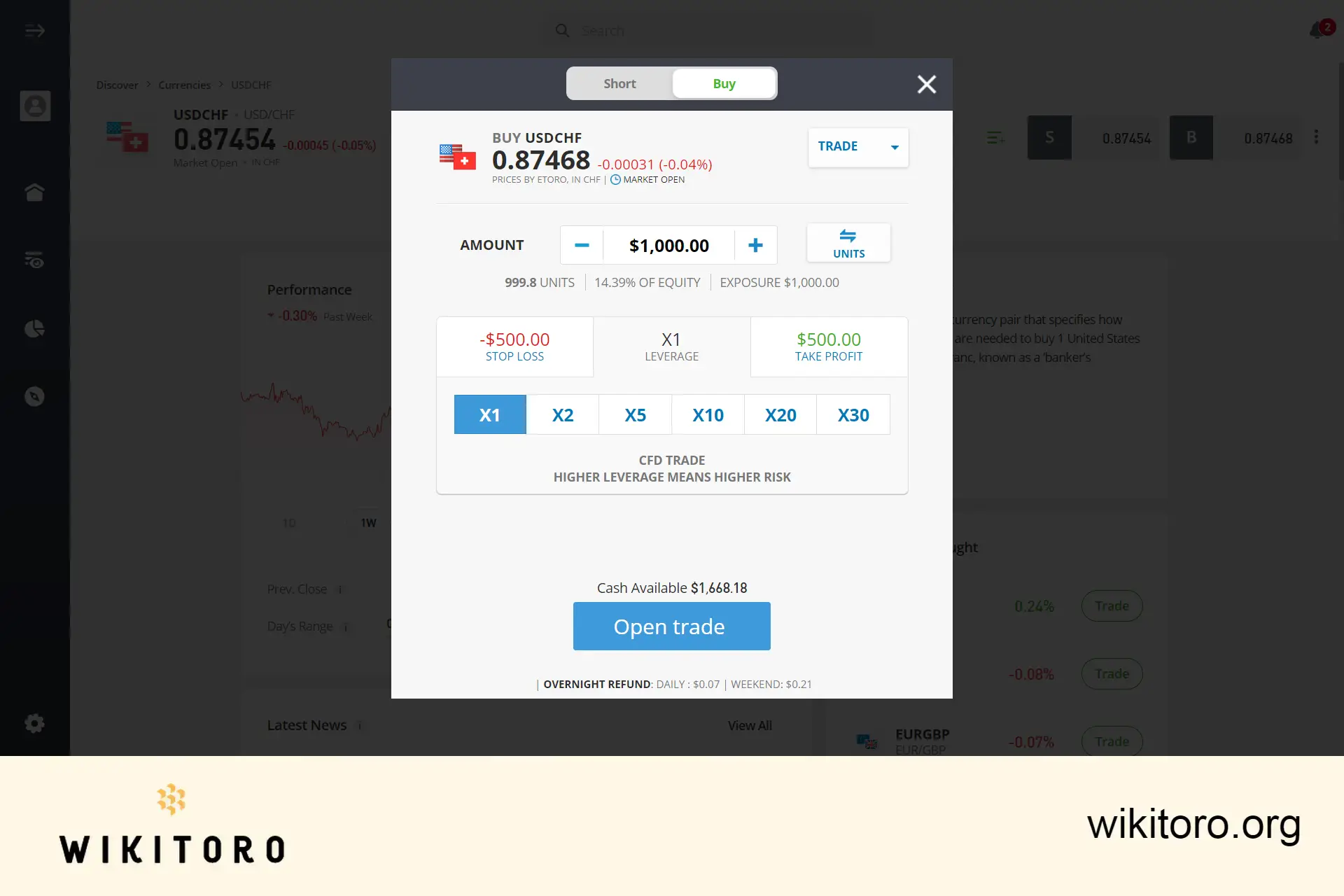

It's important to recognize that trading USD/CHF on platforms like eToro involves Contract for Differences (CFDs), not a physical exchange of currencies. CFD trading fascinates me due to its ability to speculate on forex market movements without needing to own the actual currencies. Crypto CFDs/ Leverage trading is restricted for users under FCA.

Having traded USD/CHF on eToro multiple times, I've identified several key benefits:

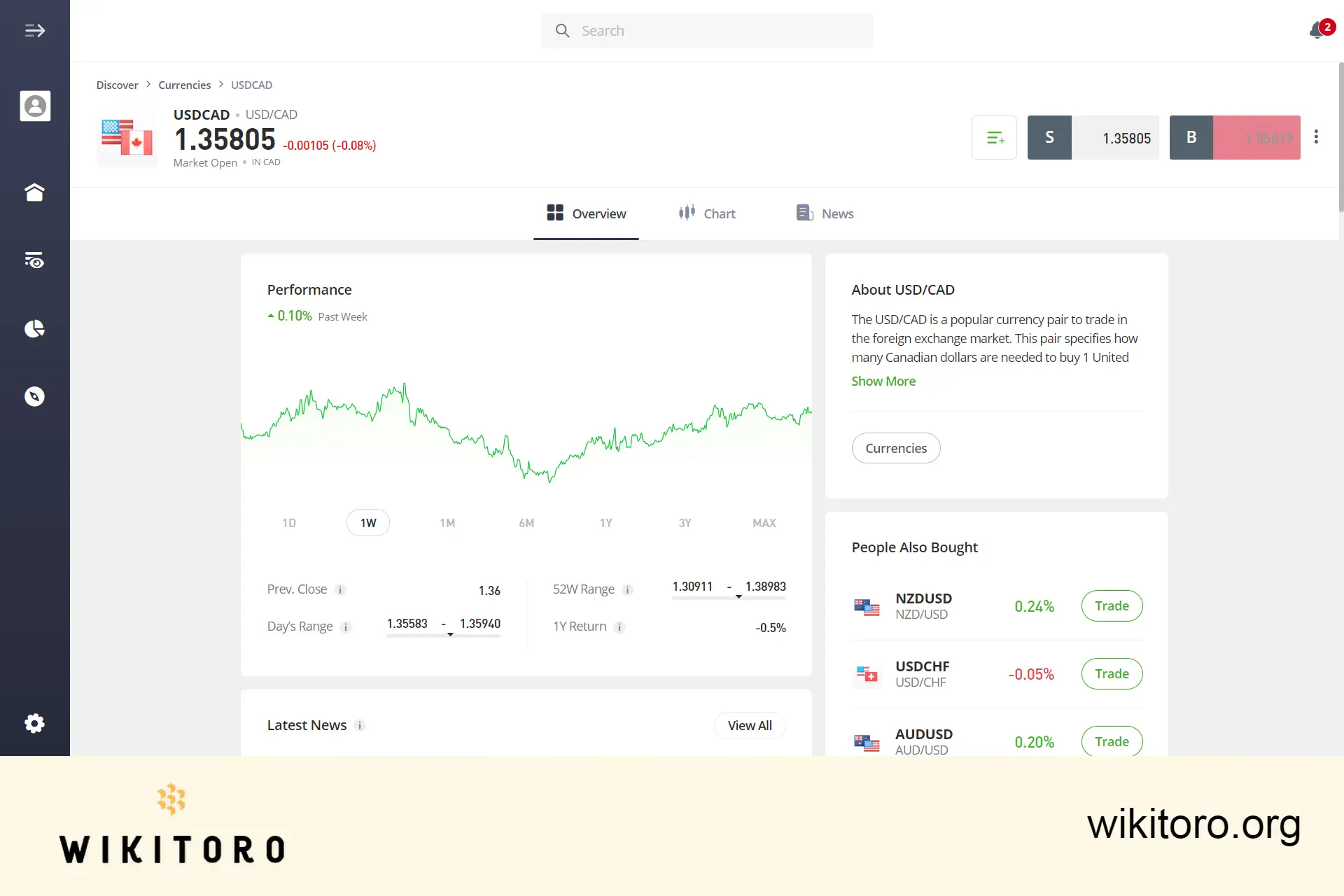

Navigating to the USD/CHF asset page on eToro, you'll land on the Overview section by default, which encompasses several key elements:

What I appreciate about eToro's platform are its integrated tools, which enhance the trading experience:

To trade this currency pair:

That sums up the essentials for trading the USD/CHF pair on eToro, whether using the web-based platform or mobile app. Remember these tips and apply them wisely in your eToro forex trading journey.

About Nadav Zelver

About Nadav Zelver