Silver, a key industrial metal, sees its value fluctuate more than gold, largely influenced by the demands of new technological advancements. Its extensive use in electrical appliances, industrial equipment, medical products, microcircuits, batteries, and superconductors ensures silver's continued high market value.

This valuable metal is also available for trading on eToro's platform. For more detailed insights, including my personal experiences, be sure to read through this guide.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

When trading silver on eToro, you're engaging in CFDs (Contracts for Difference) rather than owning the physical metal. The allure of CFD trading lies in its ability to speculate on market movements without the need for physical possession. Crypto CFDs/ Leverage trading is restricted for users under FCA.

Having traded silver on this platform multiple times, I've observed several benefits:

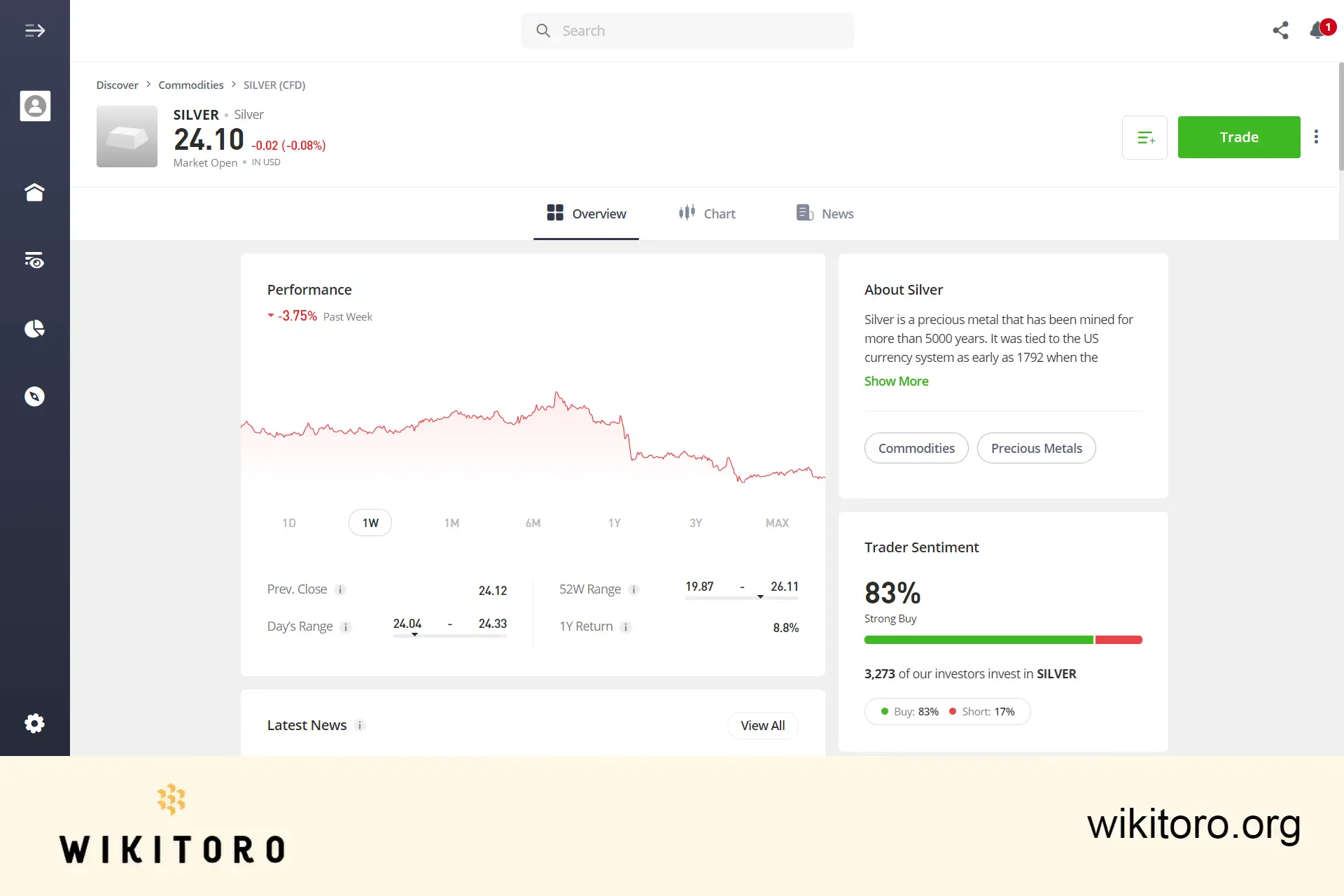

Upon accessing the Silver asset page on the platform, you'll land on the Overview section. This default view includes several elements:

eToro's platform includes several useful tools for trading Silver:

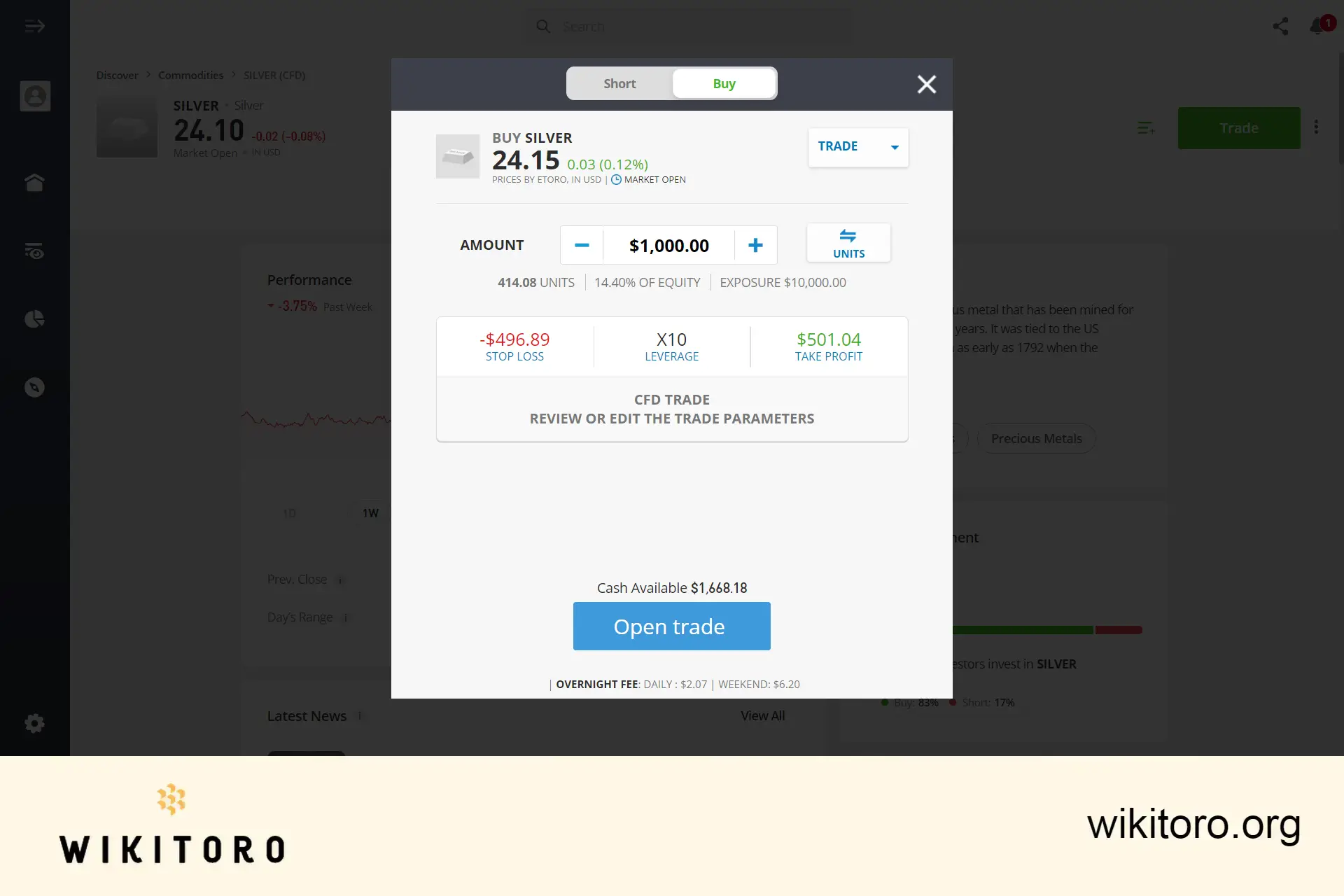

Want to how do I invest in Silver on eToro? To trade this commodity, search for the asset, select "BUY" or "SELL," enter your investment amount, set your trade preferences, and execute the trade.

You may incur an overnight fee for trading this asset if you decide to keep it open overnight. But what are the overnight fees on silver on eToro? The exact amount can vary depending on market conditions and is charged per unit per night for both buy and sell positions.

That concludes my guide on trading Silver with eToro, available through both their web-based platform and mobile app. Remember to apply these insights wisely on your online trading journey.

About Mike Druttman

About Mike Druttman