Copper, a versatile and vital metal, has been central to human progress ever since its properties and applications were discovered. It's essential in numerous sectors, such as home plumbing and power generation, earning its status as the world's third most used metal. Given its widespread use and large-scale global demand, copper remains a highly sought-after commodity in international markets.

One prominent method to trade or invest in copper is through CFD (Contracts-for-Difference) trading. This derivative allows traders and investors to speculate on copper's value without owning physical assets like ETFs, bullions, options, futures, or mining shares. Notably, copper is also tradable on the eToro trading platform. For detailed insights and personal experiences with copper trading, don't miss the comprehensive guide I've prepared.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

It's important to understand that trading copper on eToro means dealing with CFDs, not the physical metal itself. The allure of CFD trading lies in its ability to allow speculative trading on commodity market movements without the need for physical ownership. Crypto CFDs/ Leverage trading is restricted for users under FCA.

Having traded copper on eToro several times, I've identified numerous benefits of using this platform:

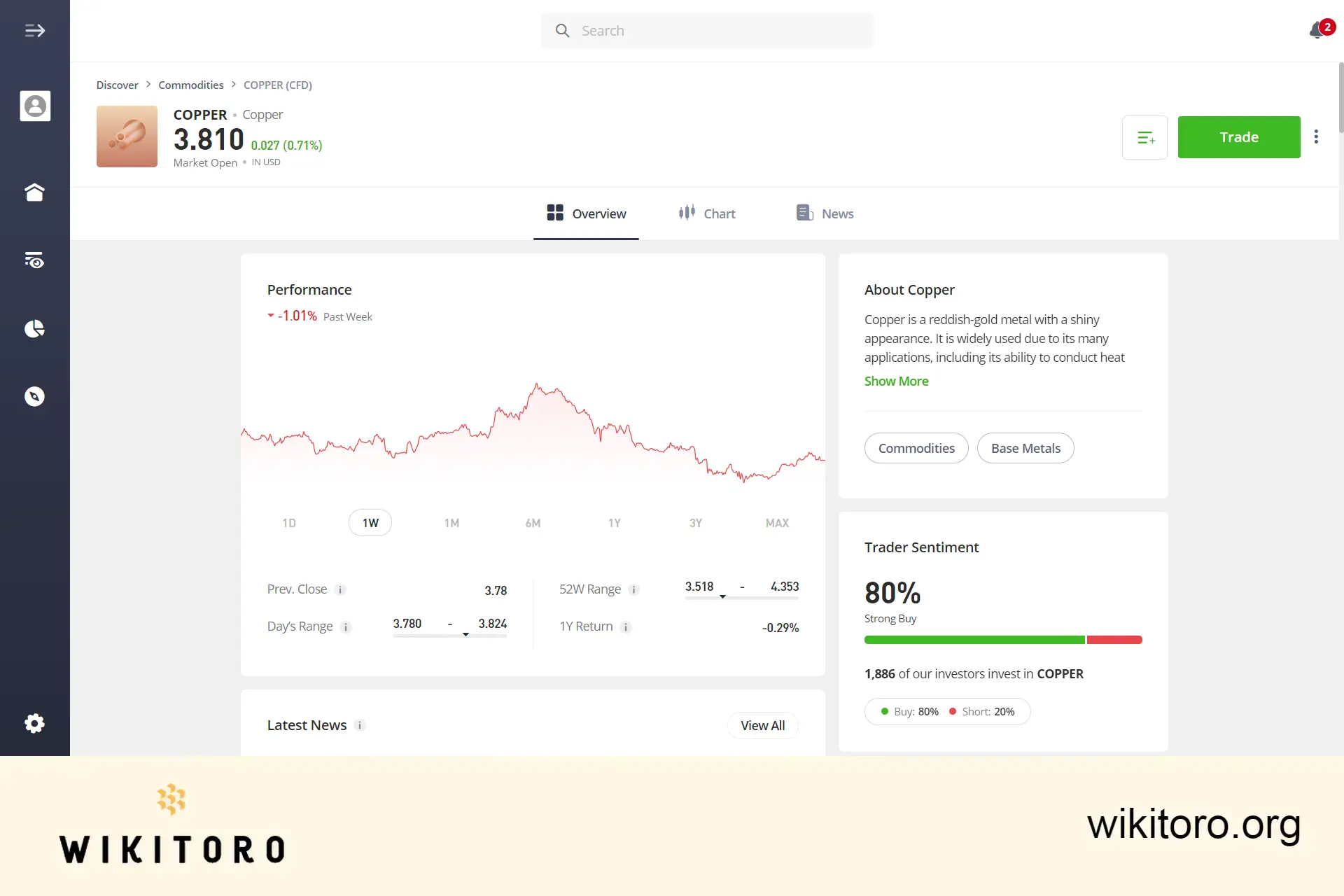

Navigating to the Copper asset page on eToro leads you directly to the Overview section. This default view presents various elements:

eToro's integrated tools enhance the trading experience:

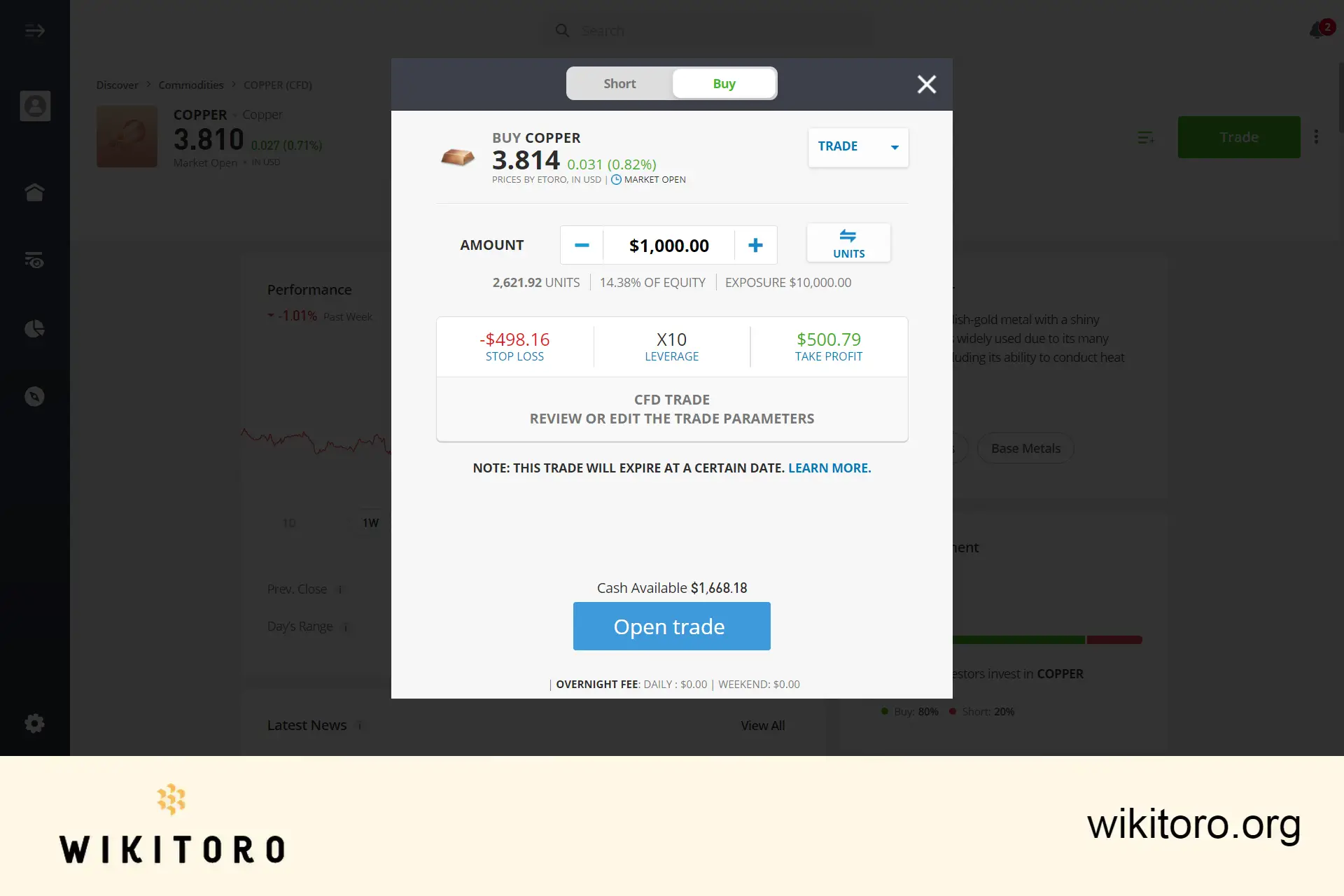

To trade copper, search for the asset, select "BUY" or "SELL," enter your investment amount, set your trading preferences, and execute the trade.

That concludes the essentials for trading copper on eToro, whether using the web platform or mobile app. Keep these tips in mind for an informed and strategic approach to your online trading endeavors.

About Nadav Zelver

About Nadav Zelver