Sugar, much like other commodities, stands as a sweet refuge amidst financial market unrest and declining stock values. Its role extends beyond pleasing taste buds; it offers investors a fairly reliable means of diversifying their portfolios. While sugar investment shares similarities with other financial instruments, it carries its unique risks. Understanding the array of investment choices in this market opens up avenues for lower-risk ventures. An added advantage is sugar's availability on eToro's trading platform. For those eager to delve into the nuances, my comprehensive guide, enriched with personal insights, awaits to illuminate your path in this intriguing investment landscape.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

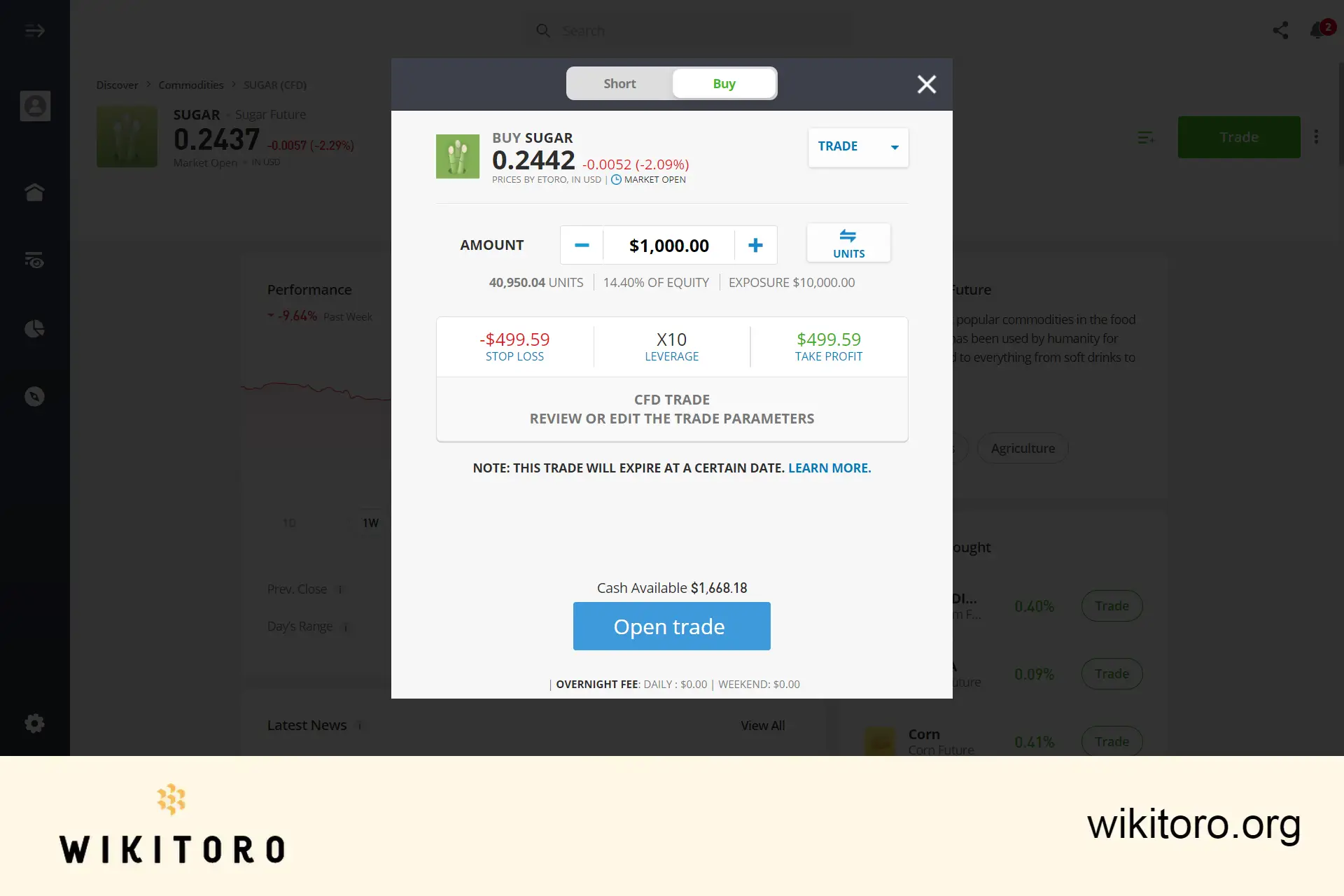

It's crucial to remember that trading sugar on this platform involves CFDs (Contracts for Difference), meaning you're speculating on its market movements rather than owning the physical commodity. The allure of CFD trading lies in its ability to let you capitalize on the market's fluctuations without the need for physical possession or storage. Crypto CFDs/ Leverage trading is restricted for users under FCA.

Having traded this asset on eToro multiple times, I've observed numerous benefits. Some of the standout features include:

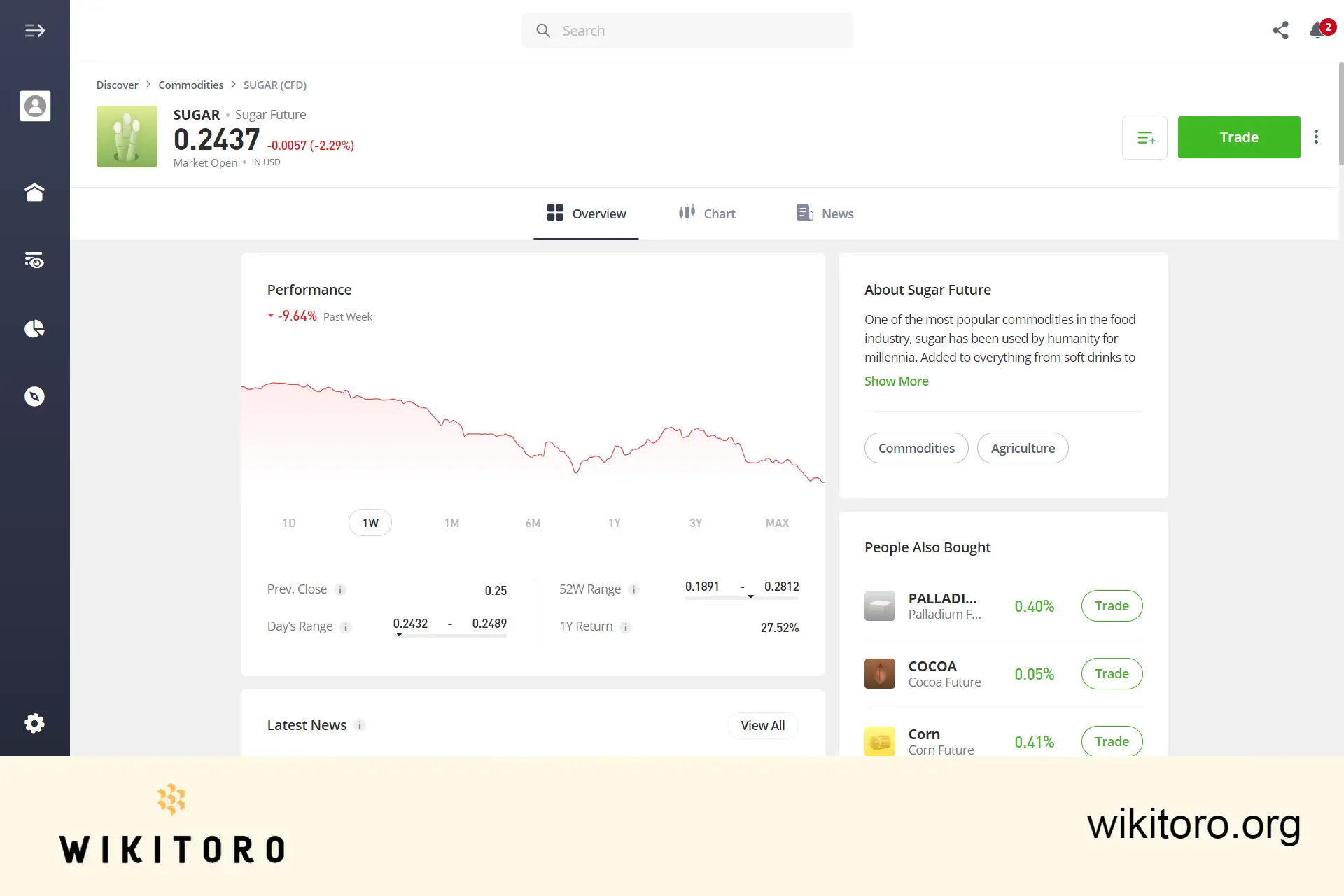

Overview Section

Upon accessing the Sugar Asset page on eToro, you're greeted with the Overview section as the default view. This section is comprehensive, featuring several key elements:

What sets eToro apart is the integration of useful trading tools, which enhance the trading experience:

To trade sugar on eToro, follow these steps:

That concludes our guide on trading sugar on eToro. Whether using the web platform or the mobile app, these insights and tips should guide you in your online trading journey with sugar as an asset.

About Nadav Zelver

About Nadav Zelver