Investing in commodities, especially cotton, can diversify your portfolio and mitigate investment risks. Commodities offer a unique market behavior compared to other assets, making them an attractive addition. Cotton, in particular, stands out for several reasons. It acts as a hedge against a weak US dollar and inflation. Even during market downturns, cotton's demand and production continue, helping it maintain a stable value. This makes cotton an intriguing investment choice. What's more, it's now accessible for trading on eToro's platform. For detailed insights and tips on investing in this compelling asset, check out the guide I've prepared, where I share my personal experiences.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

When you trade cotton on eToro, you're engaging in CFD (Contract for Differences) trading, meaning you speculate on its market price movements without owning the physical commodity. The allure of CFD trading lies in its flexibility and convenience – it enables speculative trading based on market trends without the need for physical storage or handling. Crypto CFDs/ Leverage trading is restricted for users under FCA.

Having traded cotton on eToro several times, I've identified numerous benefits:

These advantages make eToro an excellent choice for those looking to trade cotton in the commodities market.

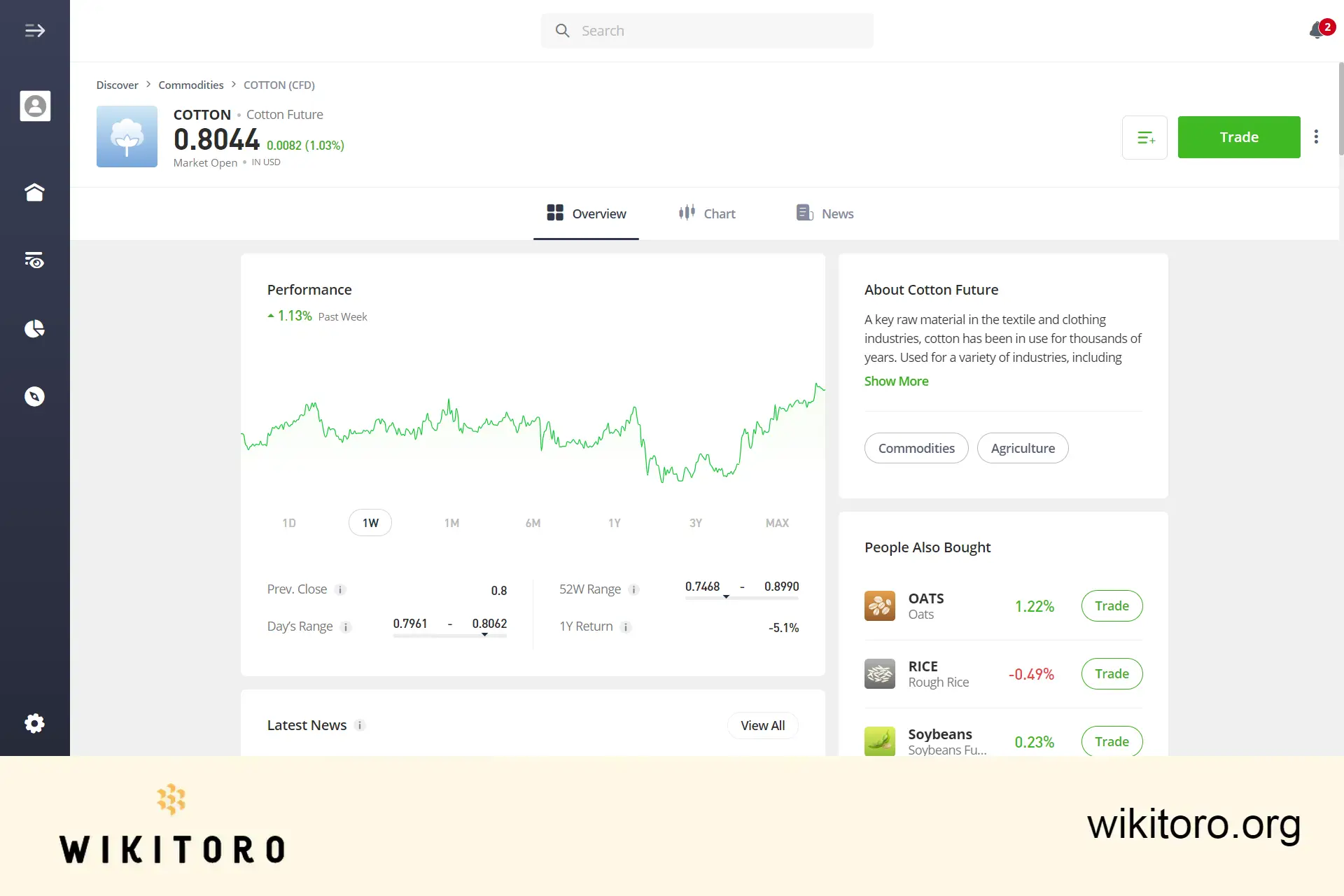

Upon accessing the cotton asset page on eToro, you'll land on the Overview section by default. This section presents various elements to enhance your trading experience:

The platform offers several integrated tools, which I found particularly beneficial for trading cotton:

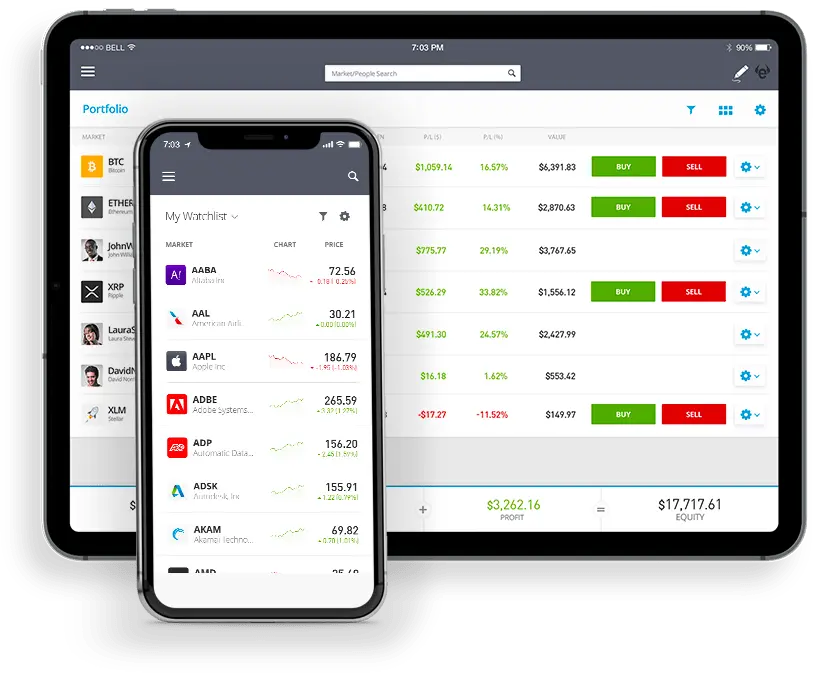

Trading cotton is straightforward:

That sums up everything you need to know about trading cotton on eToro, whether using their web platform or mobile app. Remember these tips and apply them wisely in your online trading journey.

About Nadav Zelver

About Nadav Zelver