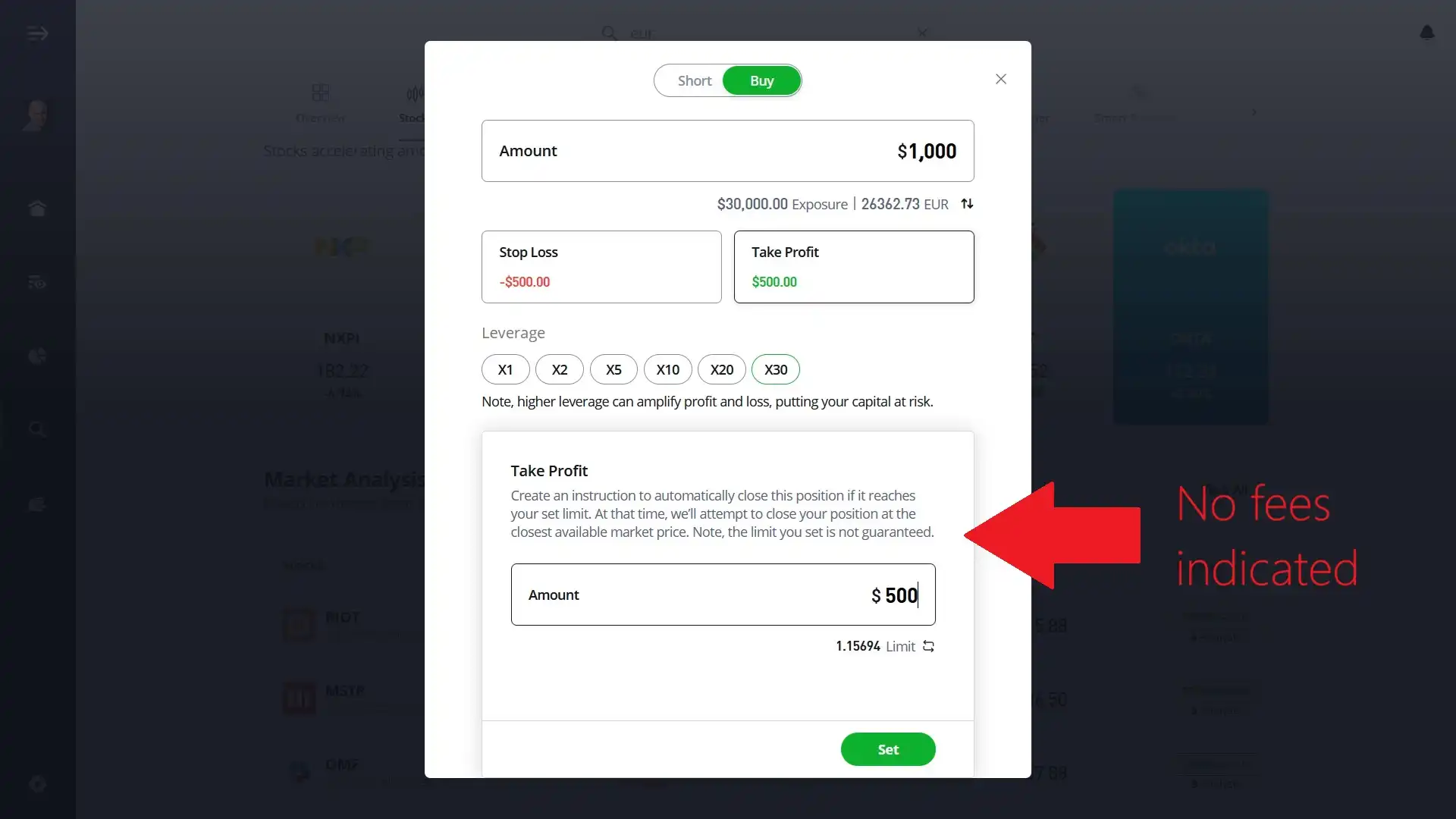

eToro does not impose a specific fee for using the Take Profit (TP) feature. However, closing a position, whether manually or through a Take Profit order, may incur standard trading fees such as spreads and overnight charges.

Here are the potential costs:

The spread is the difference between the buy (ask) and sell (bid) prices of an asset. eToro incorporates this cost into the price when you open or close a position. The spread varies depending on the asset class:

| Asset Type | Spread |

| Stocks | Typically around 0.15% per side for US stocks |

| Crypto | A flat 1% fee is applied when buying or selling |

| Forex and Commodities | Can start from 1 pip for major currency pairs. |

If your position remains open overnight, you may be charged an overnight or rollover fee. This fee is calculated based on the asset and the size of your position. For example, holding a leveraged position in a cryptocurrency or stock CFD overnight would incur such a fee.

Setting a Take Profit order itself is free but closing a position through this feature may involve these trading fees that were mentioned. I suggest that you take into consideration these potential expenses when planning your trades on eToro.

About Mike Druttman

About Mike Druttman