As a singular broker on its own platform, eToro usually has a slightly higher spread compared to others in the industry. However, eToro's advantage can be found on its Copy Trading feature that doesn't create a "slippage" when an investor copy a trader. This advantage makes up for the high spread.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

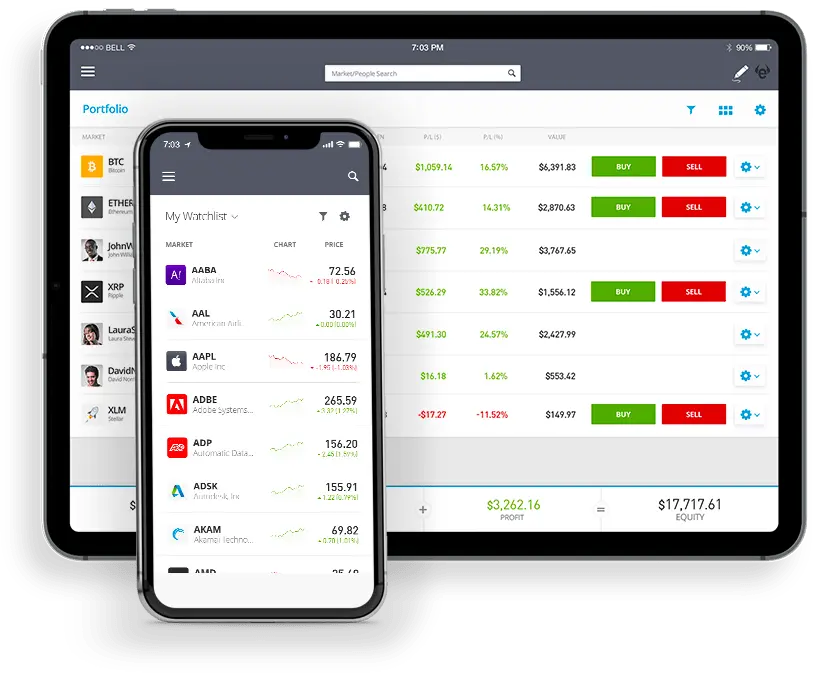

eToro stands out with its diverse range of features, tailored to suit different trading strategies and preferences. In this article, I will focus on two critical elements of the platform: the spread policy and the CopyTrader feature. Wondering how these aspects interplay with the higher spreads? Keep reading to find out.

eToro operates with a spread structure that is slightly higher than what is commonly seen in the industry. This aspect is crucial for traders to consider, as spreads are a fundamental part of trading costs. A spread is essentially the difference between the buying and selling price of an asset. While the platform's spreads might be higher, it's important to weigh this against the overall value and features the platform offers particularly copy trading.

One of eToro's standout features is its copy trading capability via the CopyTrader system. If you're not yet familiar with this concept, this allows you to mimic or literally copy the trades of more experienced investors on the platform. It's a valuable tool, especially if you're novice trader or someone who's looking to diversify your trading strategies.

So what's the deal with copy trading and what is it's relevancy with the spreads? A significant advantage of CopyTrader is the absence of "slippage." Slippage occurs when there is a difference in the price at which a trade is expected to be executed and the price at which it is actually executed. This can happen due to market volatility or delays in order execution.

However, in the platform's CopyTrader, when you copy a trader, the trades are executed at the same price, without slippage. This feature ensures that you, as the copier, experience the same entry and exit points as the primary traders, making the process transparent and equitable.

⚖️ Weighing the pros and cons

While this broker's higher spreads might initially seem like a drawback, the benefits offered by its CopyTrader can offset this aspect. The ability to copy trades without slippage provides an opportunity for you to potentially increase your success rate by leveraging the expertise of seasoned traders.

While eToro spreads are on the higher side compared to other brokers, the platform's unique Copy Trading feature, which eliminates slippage, presents a compelling advantage. So if you're considering investing on this platform, you should evaluate how the combination of these features aligns with your trading goals and strategies.

About Nadav Zelver

About Nadav Zelver