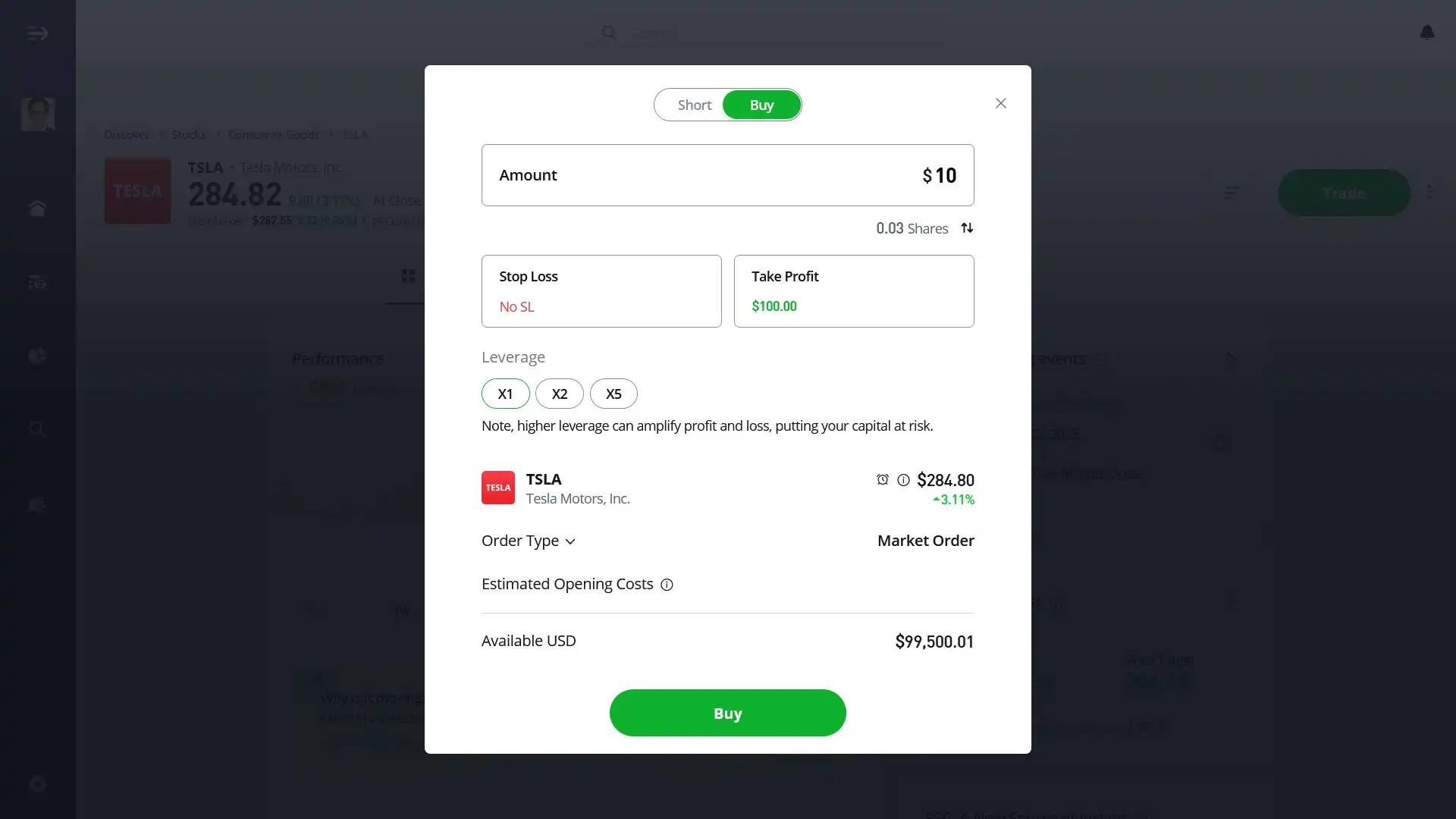

A fractional share on eToro is exactly what it sounds like: a slice of a full stock. Instead of buying an entire share, you put in any amount you want (starting from $10) and own a portion of it.

No need to break the bank just to buy big-name stocks. Want a piece of Apple, Tesla, or Amazon? Pick an amount ($10, $50, whatever you prefer) and you’re in.

Fractional shares mean you can split your money across multiple stocks or ETFs. Put exact dollar amounts wherever you want and build a wider portfolio without needing a huge lump sum.

Own part of a share, get part of the dividend. If you hold 0.25 of a share, you’ll get 25% of the payout when dividends drop.

eToro batches up everyone’s fractional buys, snaps up whole shares on the open market, then allocates the right slice to each account.

Selling works the same way. Pick an amount or fraction to sell, confirm it, and your cash lands in your account.

Personally, I like that eToro’s fractional shares let me put small amounts starting at $10 into big-ticket stocks. It’s a simple way to spread funds over different picks without committing thousands at once. Just keep in mind the minimum trade amounts and check that some shareholder rights or tradability can differ from full shares.

About Mike Druttman

About Mike Druttman