To create a Tesla stock portfolio on eToro, you can start by directly purchasing Tesla stocks (TSLA) on the platform. Alternatively, you can trade stock CFDs, especially if you're interested in using leverage, but be aware of regional restrictions on CFD trading. Another option is to use the CopyTrader feature to mimic the trades of experienced Tesla investors.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

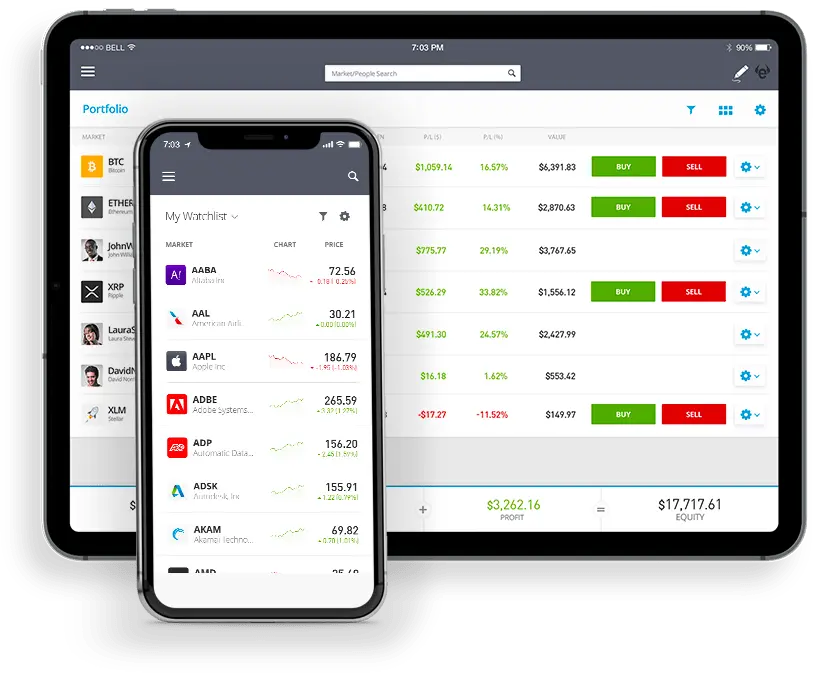

Embarking on a journey to build a Tesla stock portfolio, I utilized my eToro online trading account to explore various investment strategies. It's important to note that these methods might not be available in all countries, so checking with this broker's customer support is advisable.

The simplest approach I found was directly purchasing stocks. By searching for 'TSLA' or 'Tesla' on the platfrom, I accessed its trading page. With a minimum of just $10, buying fractional shares is possible, making it an accessible option for many investors. The process is straightforward: you enter your investment amount and place the order.

Another avenue is trading eToro Tesla stock CFDs (Contracts for Difference), especially when using leverage. It's crucial to understand that leveraging shifts the investment from buying actual stocks to trading on the expected future value of this company's stocks with this broker.

Keep in mind: eToro CFD trading is restricted in certain jurisdictions, including the USA so be sure to check if this is available in your country.

A unique feature I explored was their CopyTrader, which allows investors to emulate the trades of experienced Tesla traders. The eToro copy trading option is an insightful way to engage in this electric vehicle maker's stock market movements. The minimum investment for this method is $200, a factor to consider for those interested in this approach.

My exploration on eToro revealed three main methods to create a Tesla stock portfolio: direct stock purchases, CFD trading (when leveraging, subject to regional availability), and using the CopyTrader feature to follow more experienced investors.

This variety provides a flexible framework for investors, accommodating direct stock ownership, trading on margin through financial derivatives, and capitalizing on the acumen of seasoned traders. The choice is yours!

About Nadav Zelver

About Nadav Zelver