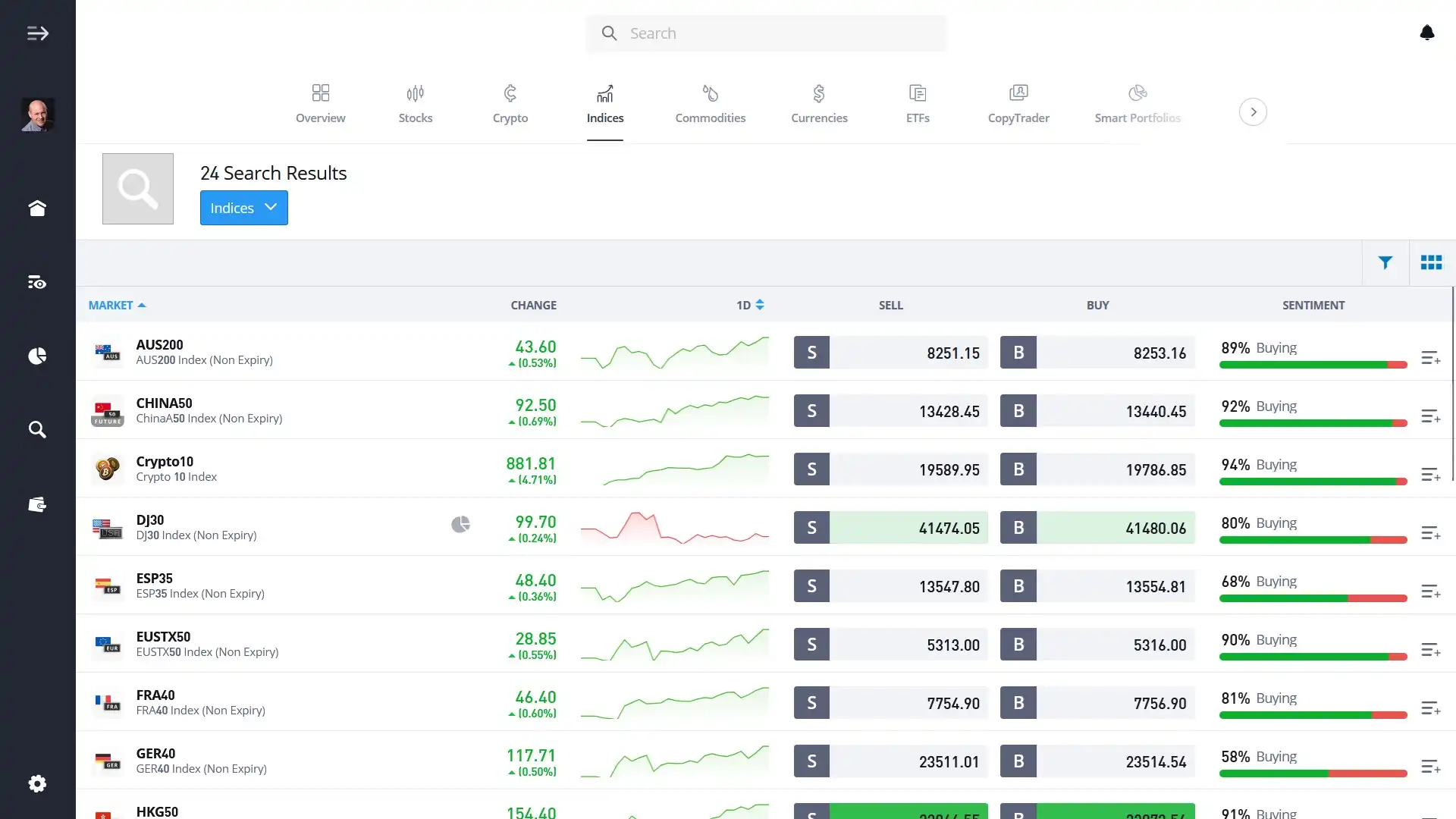

eToro lets you tap into around 20 global stock indices through Contracts for Difference (CFDs). That means you can trade the ups and downs of major markets without actually owning any of the assets.

eToro gives you access to some of the most important indices across global markets. Here’s what’s on offer:

| Index | Description |

| S&P 500 (SPX500) | Tracks 500 of the largest U.S. companies. |

| NASDAQ 100 (NSDQ100) | Focused on top-tier non-financial U.S. firms, with a heavy tech presence. |

| Dow Jones (DJ30) | 30 major U.S. corporations from a range of sectors. |

| FTSE 100 (UK100) | The 100 top-performing companies on the London Stock Exchange. |

| DAX 40 (GER40) | Germany’s biggest players, listed in Frankfurt. |

| CAC 40 (FRA40) | 40 of France’s most prominent firms. |

| Euro Stoxx 50 (EUSTX50) | A mix of 50 heavyweights from the Eurozone. |

| Nikkei 225 (JPN225) | 225 leading Japanese companies. |

| Hang Seng (HKG50) | 50 of the biggest names in Hong Kong. |

| FTSE China A50 (CHINA50) | 50 large-cap Chinese stocks. |

| ASX 200 (AUS200) | Australia’s top 200 listed companies. |

| IBEX 35 (ESP35) | 35 key players in the Spanish market. |

| Singapore Index (SGX) | Tracks top companies in Singapore. |

| Netherlands 25 (NL25) | 25 significant Dutch firms. |

| Russell 2000 (RTY) | Covers 2,000 small-cap U.S. companies. |

| US Dollar Index (USDOLLAR) | Measures the dollar’s strength vs. a basket of global currencies. |

| VIX Future (VIX) | The market’s go-to volatility benchmark. |

| Crypto 10 Index (Crypto10) | A basket of the top 10 largest and most liquid crypto by market cap. |

Prefer a passive play?

If hands-on trading isn’t your thing, eToro also offers ETFs that track these indices. It’s a one-click way to get diversified market exposure without managing individual trades, which I recommend that you explore as well.

About Mike Druttman

About Mike Druttman