Yes, eToro allows you to hold index-tracking positions for the long haul, whether you’re investing through ETFs or trading index-based CFDs.

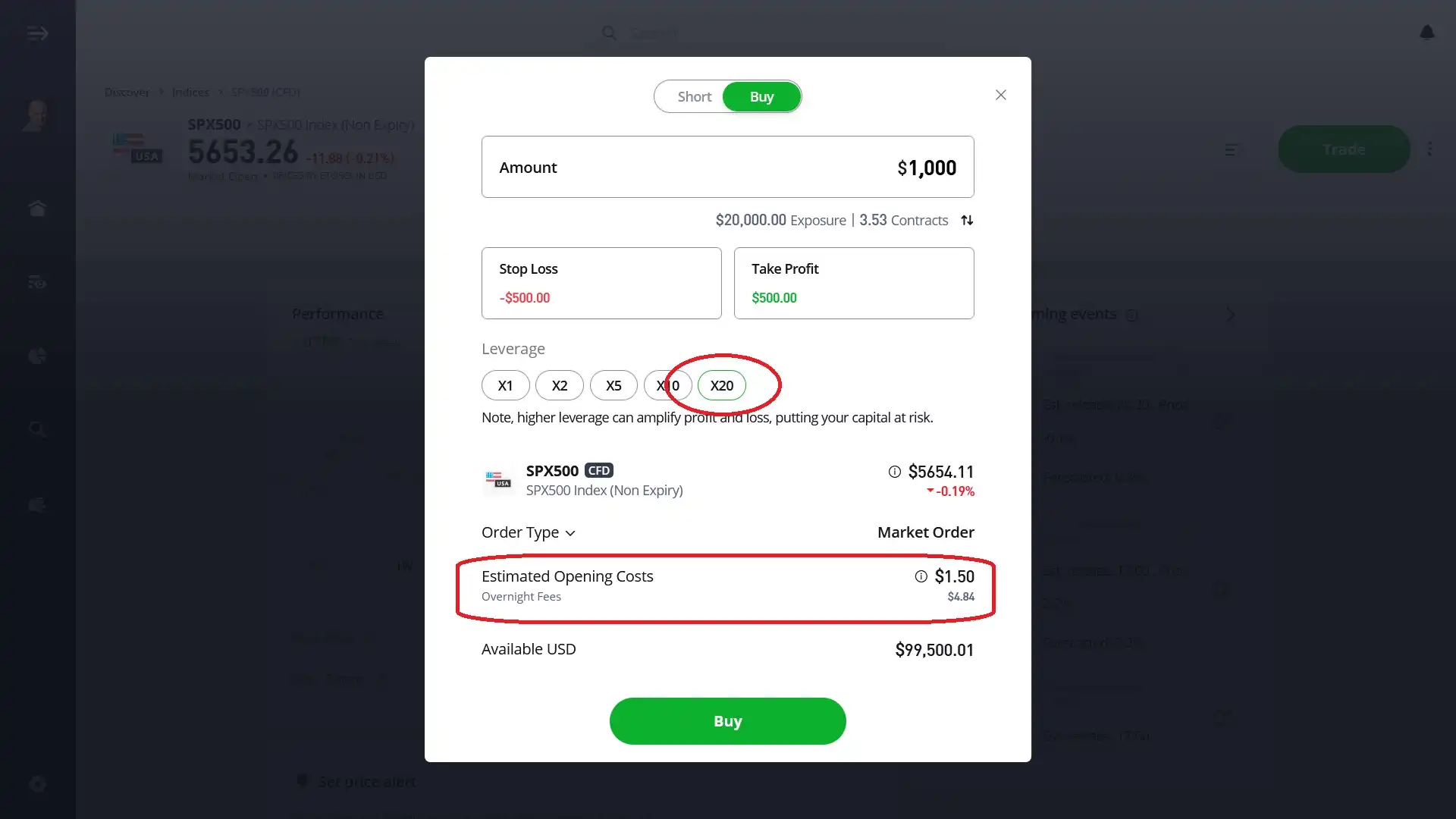

If you're thinking long-term, go with ETFs that don’t use leverage. Why? Because leveraged trades rack up daily financing fees. That’s money out of your pocket for every extra day you’re holding.

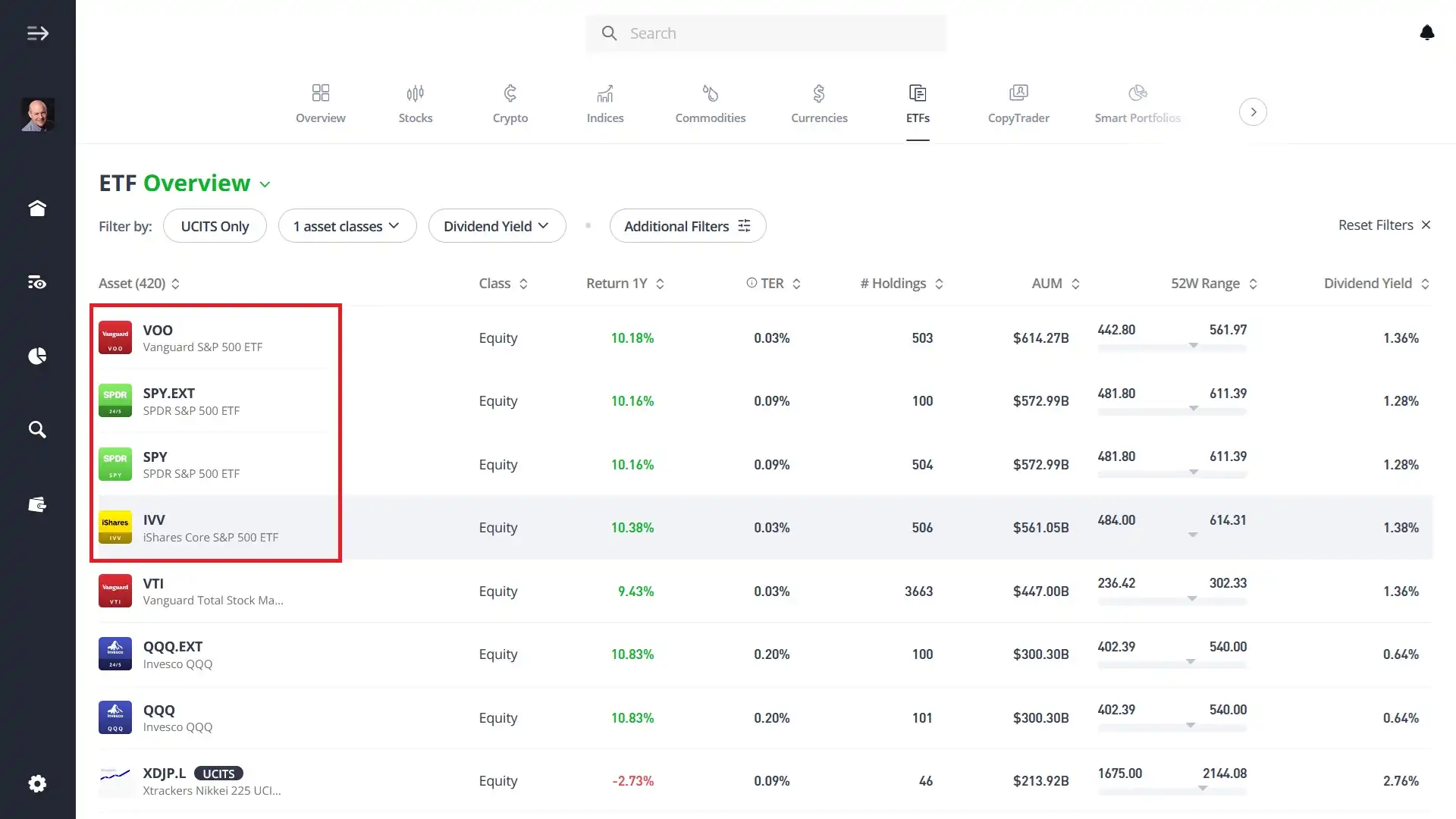

Unleveraged index ETFs (like those tracking the S&P 500) have a track record for growth and are far more cost-efficient over time.

You’ll find plenty of these options on eToro’s platform. And yes, they’re designed for investors who want to set their positions, monitor performance, and grow capital without micromanaging every trade.

There’s one catch: you can’t transfer positions out of eToro. If you ever decide to move to another platform, you’ll need to close everything first. No cross-platform transfers here. That doesn’t affect your returns, but it does matter for future planning.

So, should you use eToro for long-term index investing?

Definitely. Just make sure you’re using unleveraged ETFs to keep costs low. And don’t forget the fine print on transfers. If flexibility between brokers is part of your plan, I strongly recommend that you factor that into your strategy.

About Mike Druttman

About Mike Druttman