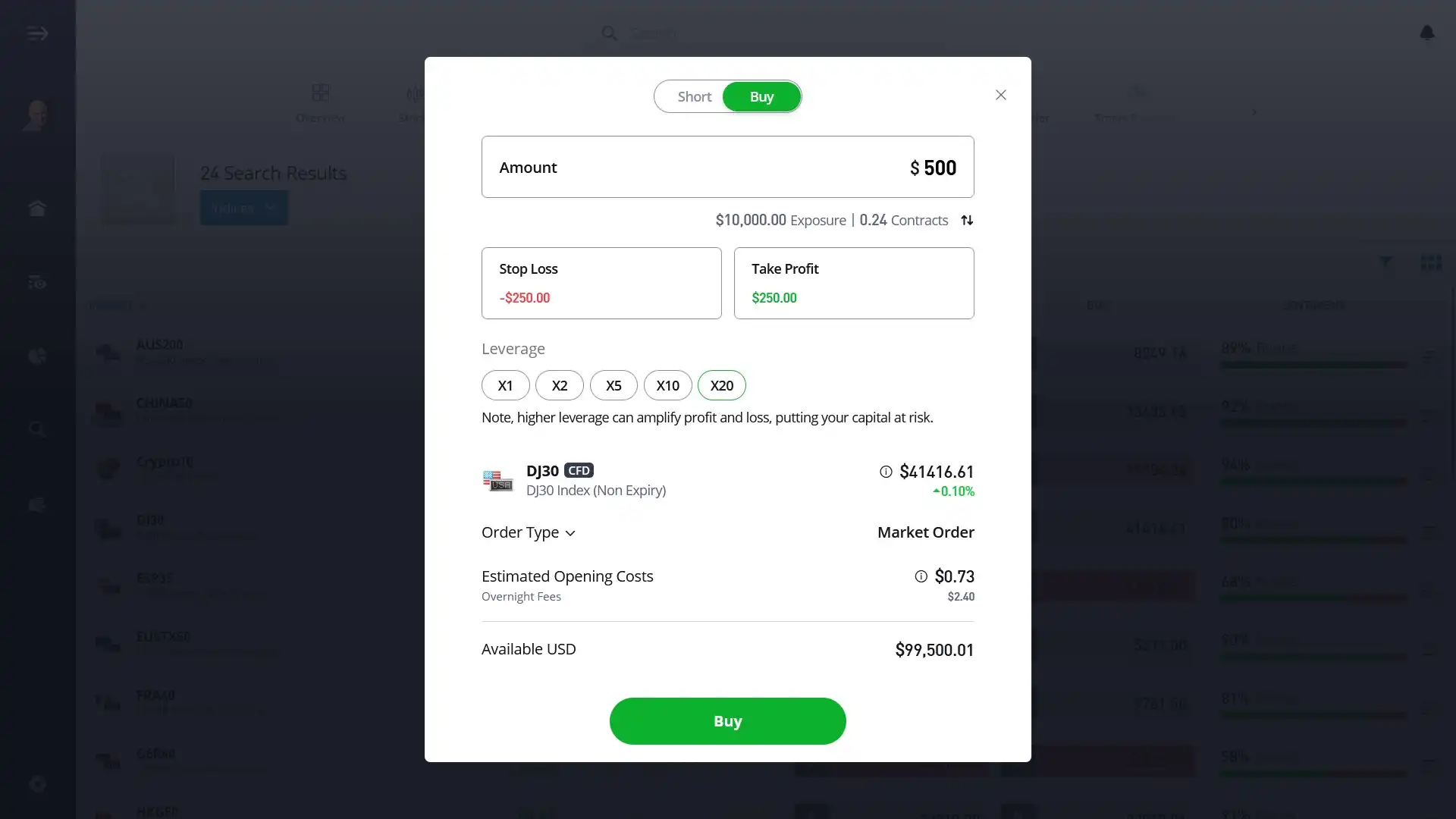

Yes, eToro charges fees when you trade indices, primarily through spreads, overnight fees, and commissions on leveraged positions. Most of them aren’t hidden, but you’ll want to know where your costs are coming from before you jump in.

Here are the fees in detail:

This is the built-in cost, the difference between the buy and sell price of the index. It’s how eToro makes part of its money on each trade. Spreads vary based on the index and current market volatility.

Worth noting: eToro’s spreads on index CFDs can run a bit higher than some other brokers.

Hold a position past market close? You’ll get hit with a daily overnight fee. These are tied to the total value of your position and fluctuate with the markets. On Fridays, that fee is tripled to cover the weekend. Plan accordingly.

If you’re using leverage on an index trade, expect a 0.09% commission, which is calculated on the full trade value. That applies when opening and closing the position.

Some personal note:

These fees change depending on market conditions, index type, and trade size. I recommend that you check the latest fee details directly on eToro before placing a trade. It’s all listed in the platform.

About Mike Druttman

About Mike Druttman