eToro charges a 1% fee when you buy crypto and another 1% when you sell. It’s rolled right into the market price the moment you open your position.

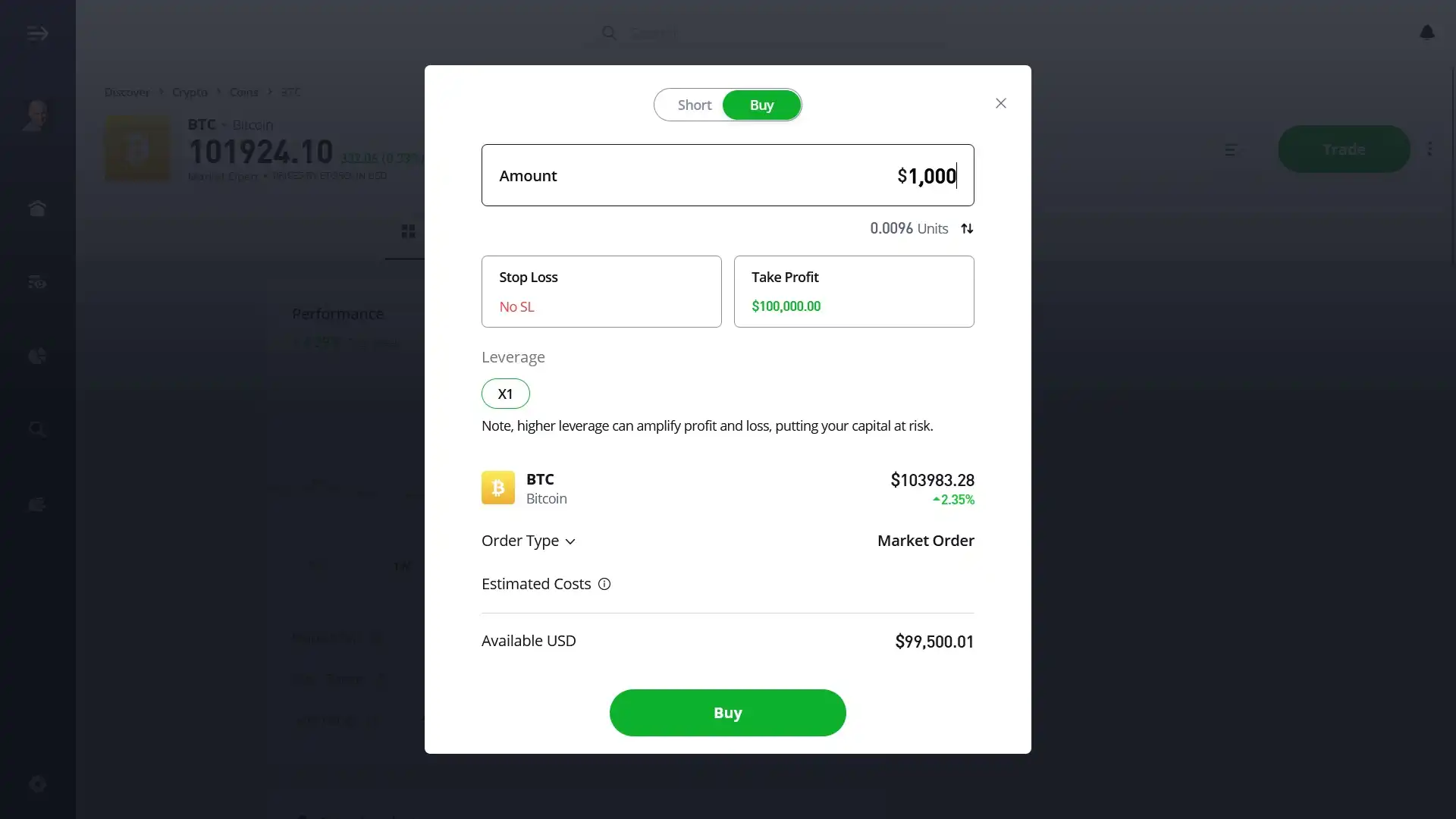

Here's an example:

Say you drop $1,000 into Bitcoin. eToro skims $10 off the top. That’s your entry fee. When you sell, they take another 1% based on whatever the market price is at that moment. If your crypto’s still worth $1,000, that’s another $10 out. So all in, you’re looking at a $20 round-trip cost or 2% of your original investment.

These fees aren’t hiding anywhere. They’re baked into the price you see on the platform. That’s why your profit and loss (P&L) will look a little in the red right after you open a position. It’s already accounting for both the buy and future sell fees. As prices shift, so will your P&L.

Why It’s Actually Simple

What I appreciate here is the transparency. That 1% covers everything: commission, handling, the works. No mental math required. You see what it costs from the start.

Now sure, eToro’s fee might be higher than some crypto-only exchanges. But for many investors, features like regulated custody and insurance coverage make that extra cost easier to justify. You're paying for peace of mind, not just the trade.

About Mike Druttman

About Mike Druttman