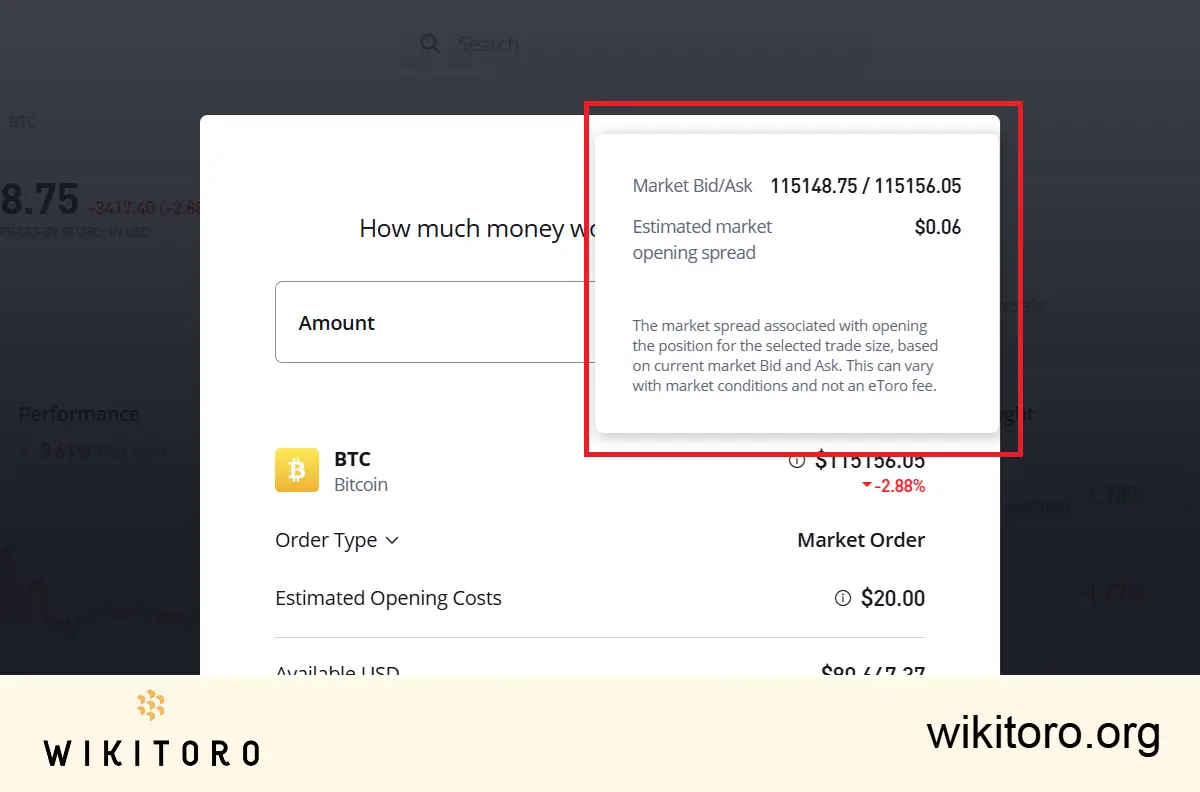

eToro’s Bitcoin prices include both the market spread and a built-in 1% commission. That’s why the buy price is above, and the sell price is below, the market rate. What you see isn’t raw pricing, it’s the cost of trading wrapped into each quote.

Every crypto trade on eToro comes with a built-in spread. That’s the gap between what you pay to buy and what you’d get if you sold immediately. It’s how eToro handles operational costs while keeping things commission-free elsewhere on the platform.

For Bitcoin, that spread shifts depending on market conditions but it’s always baked into the price you see.

Instead of pulling prices from one place, eToro aggregates data from multiple sources. This lets them manage both liquidity and volatility in real time.

But during fast-moving markets, things get tricky. To manage risk, eToro may widen the spread slightly to stay ahead of the swings.

This isn’t Binance or Coinbase. You’re not trading peer-to-peer.

eToro acts as your trading partner. It sets the prices using its own pricing engine, not a public order book. That structure can lead to small price variations compared to typical exchanges.

Crypto may be 24/7, but eToro still applies safety measures when things get thin, like over holidays or in volatile windows.

In those moments, you might notice small delays or price buffers compared to global spot rates. That’s intentional.

With eToro, you're getting more than a price quote. You’re getting copy trading, access to multiple assets, and regulated account protection.

That convenience? It shows up slightly in the spread. And for me, that tradeoff is worth it.

About Mike Druttman

About Mike Druttman