Thinking about buying Bitcoin after its price hits a record high? It comes down to your risk tolerance and long-term view. If you believe in Bitcoin’s future, consider dollar-cost averaging. You can buy real Bitcoin on eToro and manage it through their secure digital wallet.

Bitcoin doesn’t behave like a stock. There are no quarterly earnings and no dividend checks. Instead, its price reacts to a mix of factors:

And yes, the price can keep climbing even at record levels. Why? Because confidence grows when more people and institutions see long-term value.

That said, price spikes are often followed by sharp corrections. So if you’re new, don’t be surprised if things get bumpy.

Are you trying to flip short-term moves or build long-term value?

Buying at a peak comes with risk, especially if you’re hoping for a quick return. But long-term investors often zoom out.

They focus on the fundamentals: Bitcoin’s capped supply (21 million coins, full stop) and the steady march toward wider adoption.

Bitcoin is a rollercoaster. Gains and losses of thousands of dollars in a single day aren’t unusual. If that makes you nervous, think carefully.

Don’t invest what you can’t afford to leave untouched. The smart move? Manage your risk. That means:

Trying to guess the bottom (or the next high) is a tough game. A lot of investors use dollar-cost averaging instead.

That means buying a fixed amount of Bitcoin regularly, regardless of the price. It won’t win headlines, but it can even out the ride.

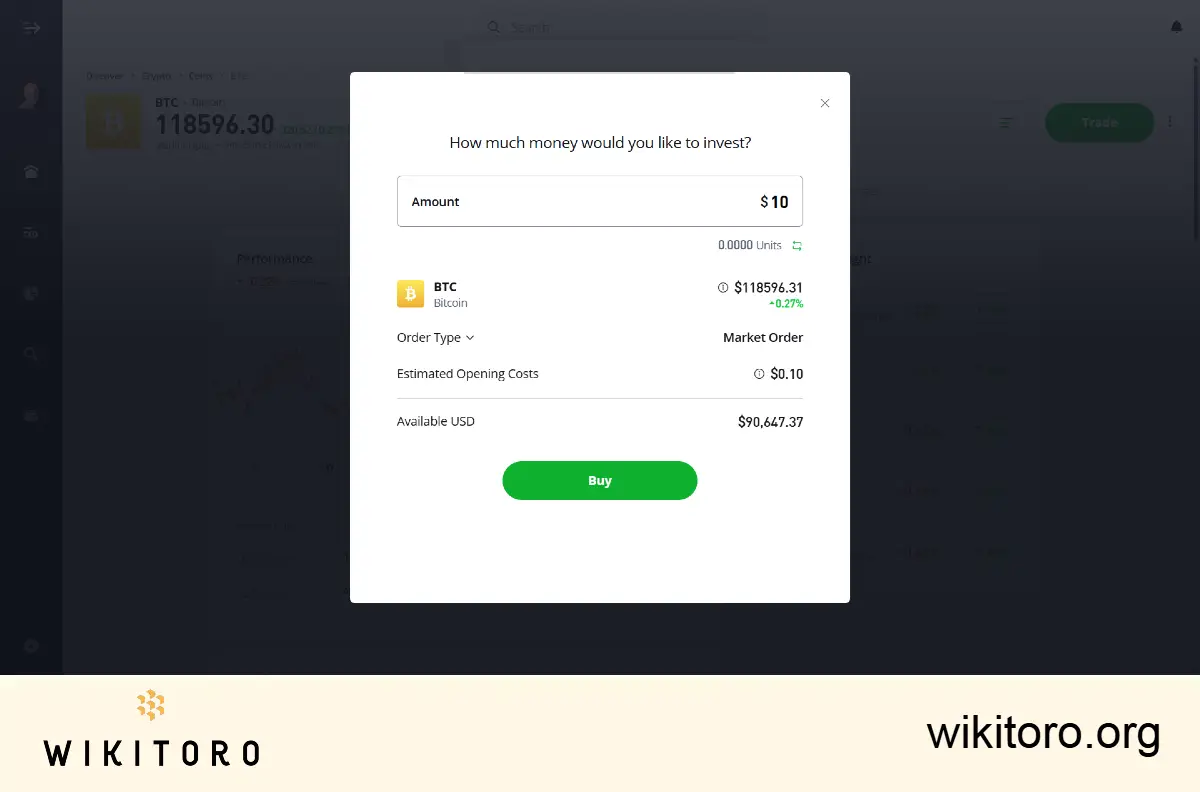

If you’re ready to take the next step, eToro makes it straightforward. You can open an account, add funds, and buy actual Bitcoin and not just speculate on price moves.

The platform also comes with a built-in crypto wallet and the ability to see how other investors are trading. It’s a good way to stay informed and make smarter decisions.

For me, if I think Bitcoin still has long-term potential in the financial system, a record high wouldn’t be a dealbreaker. I’d still consider investing, as long as it fits my broader financial goals and I’m clear on the risks. If the volatility feels like too much, I might wait. Or I’d start small with an amount I’m okay seeing swing up and down.

About Mike Druttman

About Mike Druttman