On eToro, a non-leveraged BUY (1x) means you're buying real Bitcoin: held by eToro, with wallet transfer possible in supported regions. Use leverage or SELL, and it's a CFD: you're trading on price, not owning the asset, and can’t transfer it to a wallet.

If you’re trading under eToro (Europe) Ltd., eToro UK Ltd., or eToro AUS Capital Pty Ltd., there’s a good chance you’re buying actual Bitcoin.

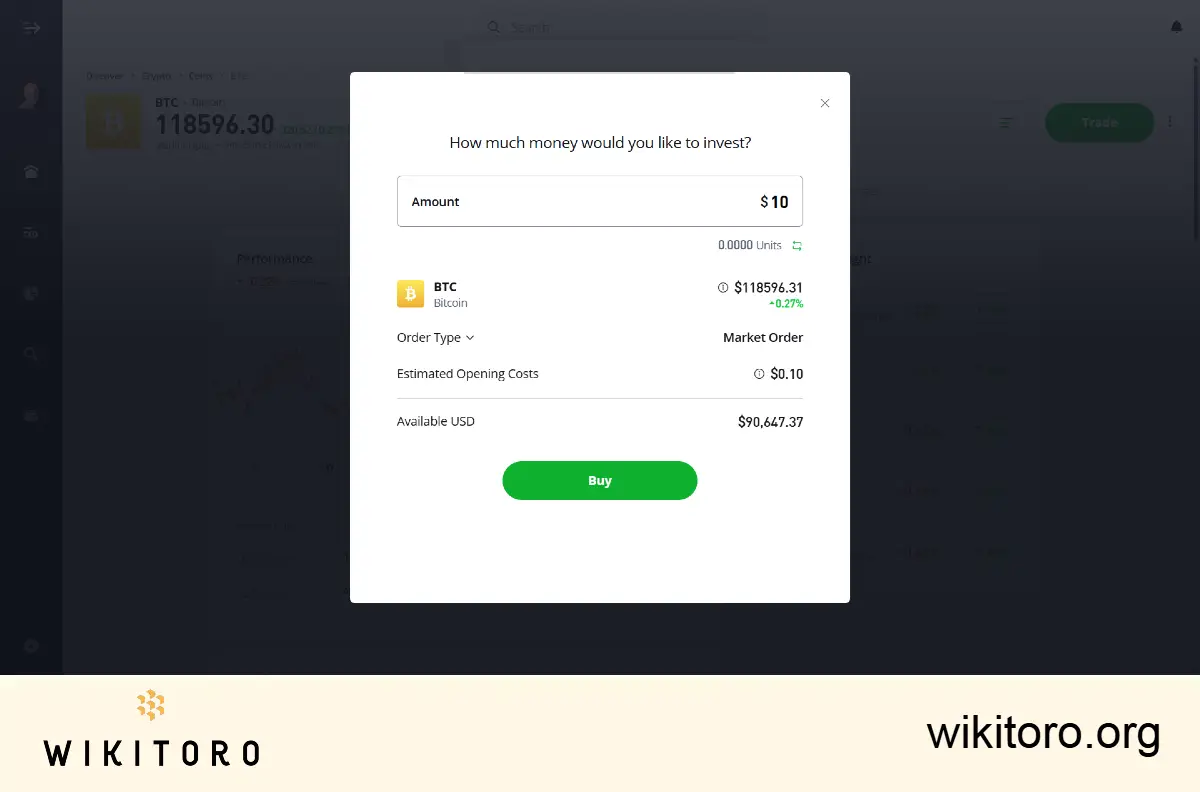

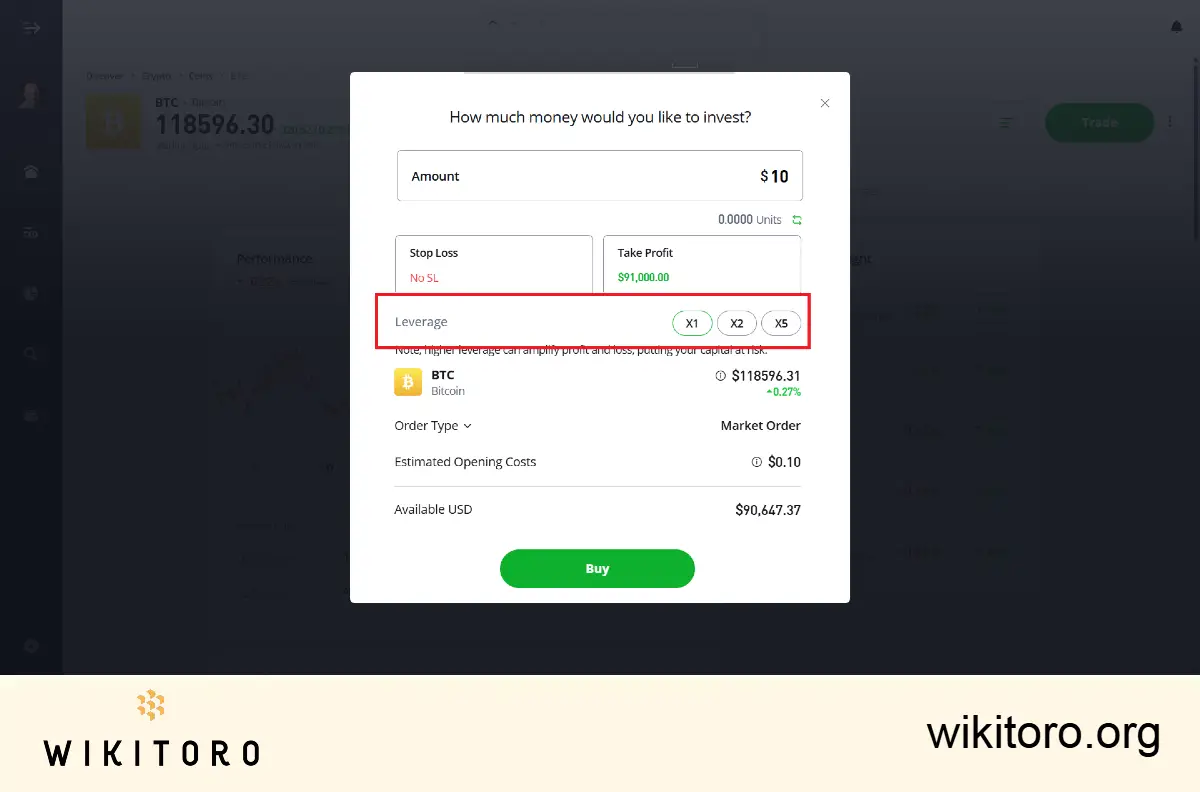

Here’s how to check: open a BUY (long) position on BTC. If you don’t see an option for x1 leverage or any labels like x1, x2, and so on, that means you’re buying the actual asset. eToro holds it for you, and in some regions, you can move it to the eToro Money crypto wallet.

Now, let’s flip it.

If you:

Then you’re trading a CFD. You don’t own any Bitcoin here; you’re speculating on price movement. That also means no wallet transfers and no withdrawals. Just the contract and the price action.

If both real Bitcoin and BTC CFDs are on the table and you're not sure which to pick, here’s my take:

- If your goal is to hold Bitcoin long-term or transfer it outside the platform, go with a non-leveraged Buy.

- If you're looking to trade with leverage or speculate on price drops, then leveraged positions or Sell (short) trades (aka CFDs) are the way to go.

About Mike Druttman

About Mike Druttman