Yes, you can. On eToro, setting stop-loss and take-profit orders for Bitcoin is built in. Just pick your price levels when opening a trade or tweak them later. Once hit, the platform handles the rest automatically. It’s how traders manage risk and secure gains.

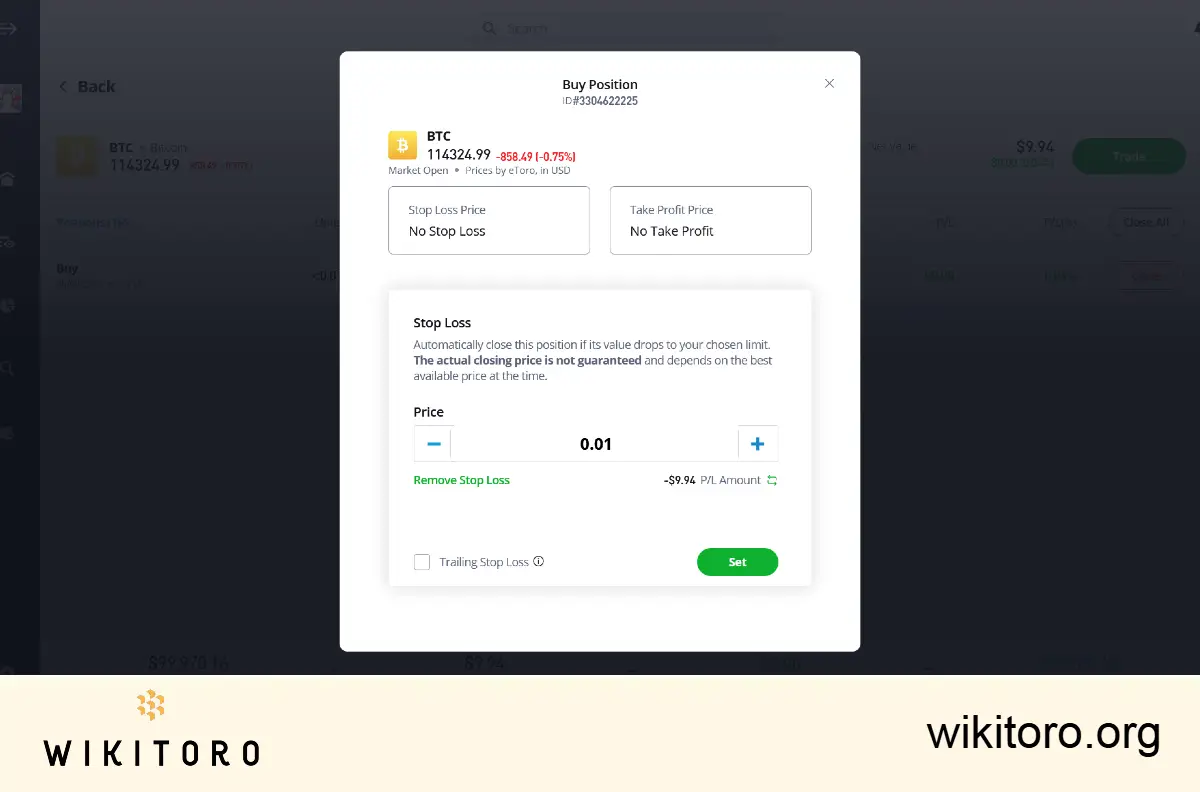

Once you’ve selected Bitcoin and decided to open a position, head to the order window. You’ll see options for setting Stop Loss and Take Profit.

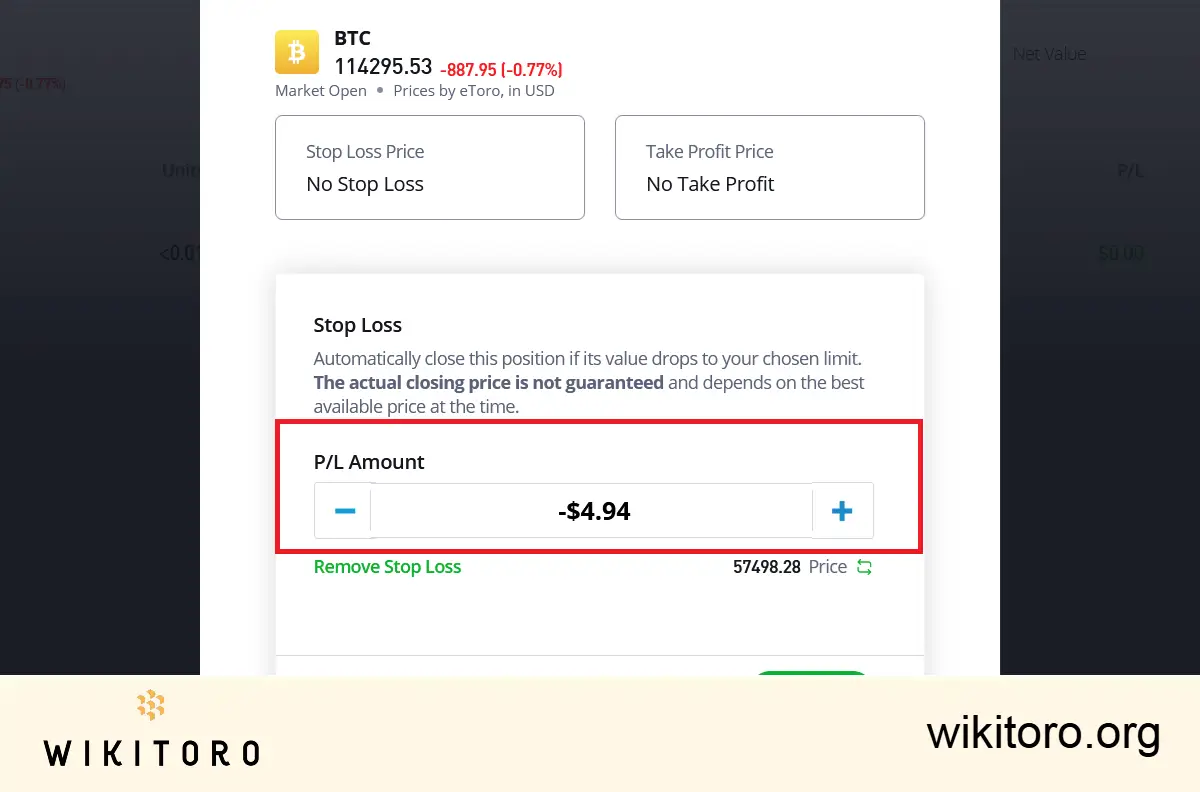

You can configure these using either Rate (as a percentage) or Amount (as a currency value). Simple enough, but each works a little differently.

Minimum limits and execution

If your trade is in profit, eToro will only let you place a Stop Loss at least 10% below the current position value. It’s a buffer, one that’s meant to give the market some breathing room.

Once either your stop-loss or take-profit level is hit, your position converts into a market order. But keep in mind that if the market’s volatile or thinly traded, your execution price might not land exactly where you hoped. That’s slippage.

Bitcoin trades non-stop and swings harder than most assets. That’s why risk management is very important. Setting a Stop Loss protects you if BTC nosedives. Using a Take Profit helps you bank gains when it spikes. And the best part? These work whether you’re actively watching the markets or no

I strongly recommend that you consider using the trailing stop loss on eToro. On the platform or app, you can set a trailing stop-loss that moves up automatically as Bitcoin’s price climbs. This way, you lock in gains while giving the trade room to grow.

About Mike Druttman

About Mike Druttman