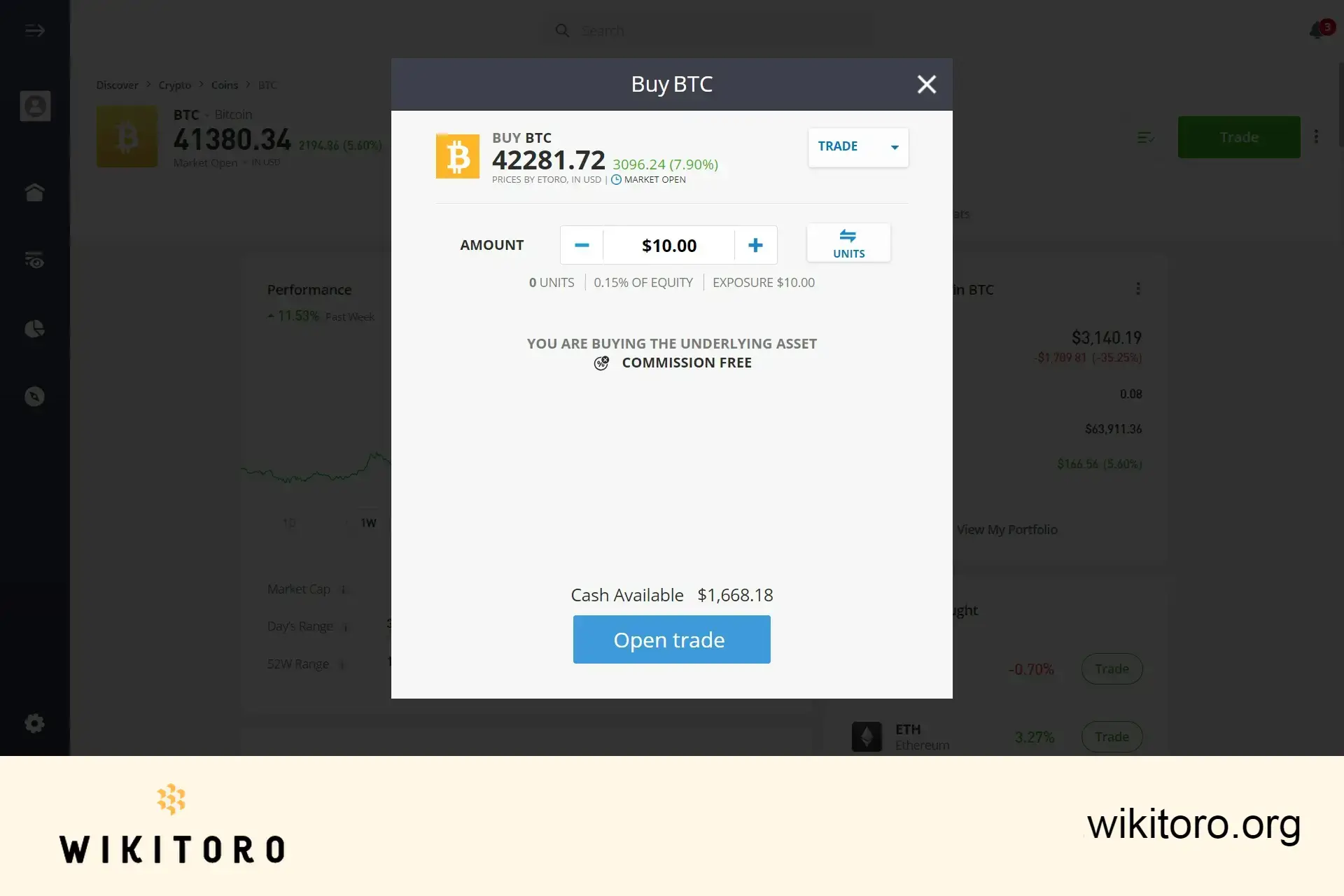

If you want Bitcoin exposure without holding the asset directly, Bitcoin ETFs offer a simple, regulated entry point. But for those who want full control (ownership, usage, and all), buying BTC directly is still the way to go. The good news is that you can do either on eToro.

Buying Bitcoin? You get the real deal. You hold actual BTC: spend it, transfer it, stash it in cold storage. But here’s the catch: the keys are yours to protect. Lose them, and it’s game over. No do-overs.

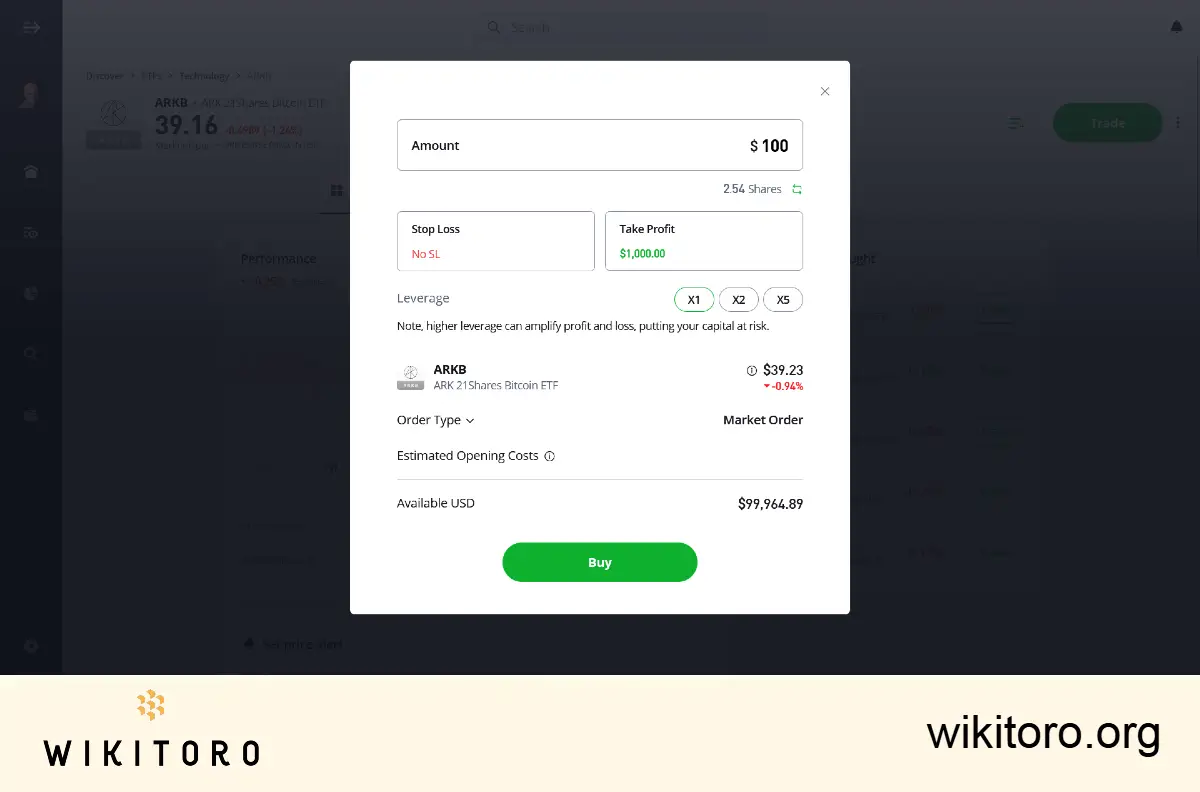

With Bitcoin ETFs, you don’t own BTC. You’re buying shares that mirror its price. The fund holds the coins and takes care of custody. No keys, no wallets, just exposure.

Holding Bitcoin directly means setting up a wallet to store these assets. The upside? You can trade anytime as markets never sleep.

eToro also gives you access to the eToro Money crypto wallet (availability depends on your region or country of residence). You can move your Bitcoin (and other supported coins) into it and then send, receive, store, or cash out, all without touching private keys.

Bitcoin ETFs run on a different schedule. You buy and sell them through a brokerage like eToro, but only during standard stock market hours. That’s less flexibility if you want to act fast.

Sell your Bitcoin and make a profit? You’ll need to report it. Gains are taxed like capital assets. That means tracking every buy, sell, and swap. It gets messy fast.

Bitcoin ETFs are treated like stocks. No crypto tax gymnastics. If you're using eToro, the reporting’s built-in so it's cleaner and simpler.

If you own Bitcoin, security is on you. That includes private keys, backups, and not clicking dodgy links. Lose access, and that BTC is gone for good.

With ETFs, security is someone else’s job. The fund handles custody through regulated channels. This shields you from user errors and most of the hacks out there.

🏆 So which one wins?Honestly, it depends on what you care about. I like Bitcoin ETFs when I want something clean, regulated, and easy to trade, feels like buying a stock. But I also like holding Bitcoin directly when I want full control and access anytime, no middleman.

Truth is, you can do both. There’s no one-size-fits-all here. It really comes down to your goals, how much risk you’re comfortable with, and whether you want to be hands-on or just keep it simple.

About Mike Druttman

About Mike Druttman