Do You Pay Tax When Withdrawing from eToro?

- Withdraw anytime even on weekends

- $5 fixed fee for every withdrawal request

- $30 minimum withdrawal amount

- Processing time typically within 1 working day

61% of retail investor accounts lose money

No. Taking money out of your eToro account doesn’t trigger a tax bill. The taxman only gets involved when you’ve made a profit from a trade, not when you move your funds.

eToro doesn’t deduct tax when you withdraw money.

Whether you’re taking out $500 or $145,000, the platform sends it to your bank, untouched.

Selling assets like crypto, stocks, or ETFs? That’s what creates a taxable event.

In the U.S., for instance, you’ll need to declare those gains or losses when filing your IRS return.

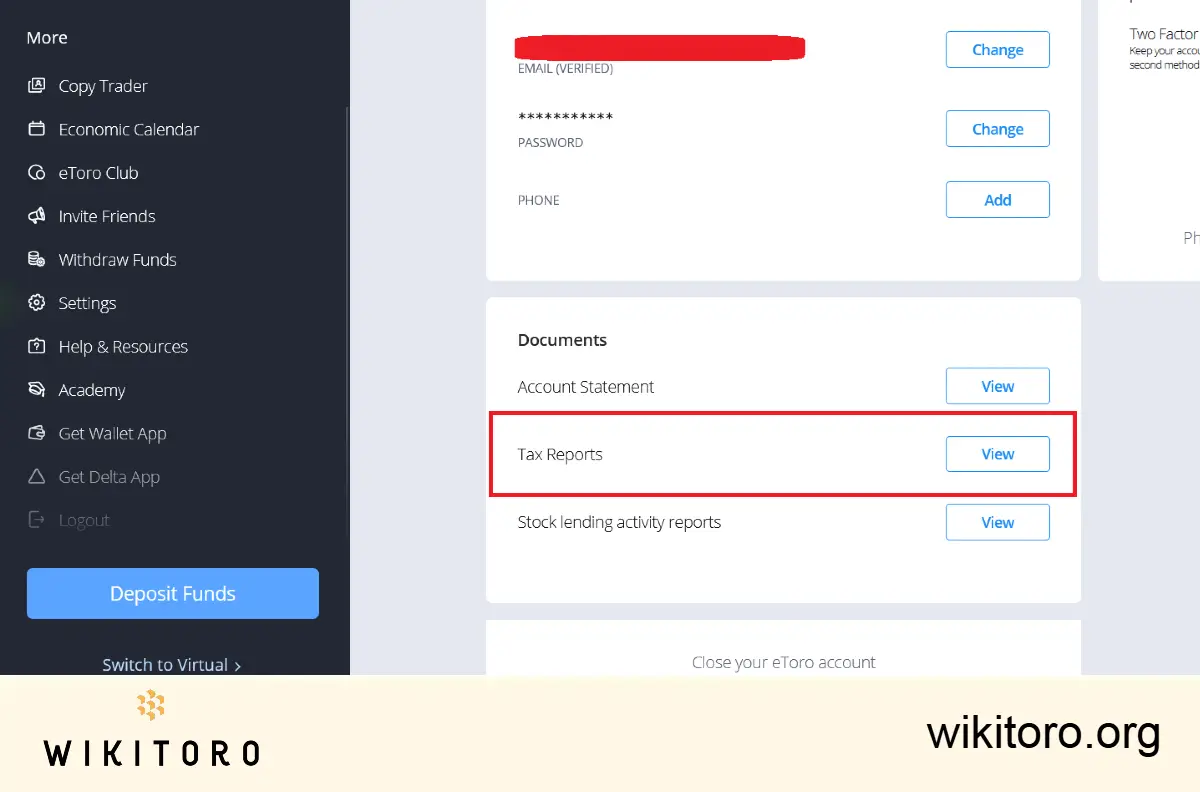

You’ll get an annual breakdown showing what you earned or lost.

It’s grouped by asset and matched with your country’s tax rules. Use this to complete your capital gains section. Withdrawals won’t appear there because they’re irrelevant to tax.

The important thing: did you make or lose money when closing a position?

That’s what counts. It doesn’t matter whether you withdraw the cash or leave it in your account. Your tax liability is locked in the moment you close the trade.

So, do you pay tax when withdrawing from eToro?

No. But you do need to report profits from your trades when tax season rolls around. Pulling money out doesn’t change that.

Here’s what you should do:

- Download your eToro Tax Report. It includes your wins and losses by asset type.

- Report realized gains (sale price minus cost) on your tax return and not the amount you withdrew.

- If you’re outside the U.S., check your country’s tax rules. Most handle capital gains in a similar way.

So there you have it. Withdrawals aren’t taxed, but your trades are. What I liked about the eToro report is that it makes it easy to declare what matters and ignore what doesn’t.

About Nadav Zelver

About Nadav Zelver