When Does eToro Charge Fees?

- No deposit fees

- No account management fees

- No fees to open an account

- Commission-free for real stocks and ETF trading

- Transparent fee structure

61% of retail investor accounts lose money

eToro charges fees at specific times and under certain conditions, depending on what you’re trading and how you’re using the platform. It’s not a flat setup. Each asset type and action comes with its own rules.

Let’s walk through exactly when those charges hit your account:

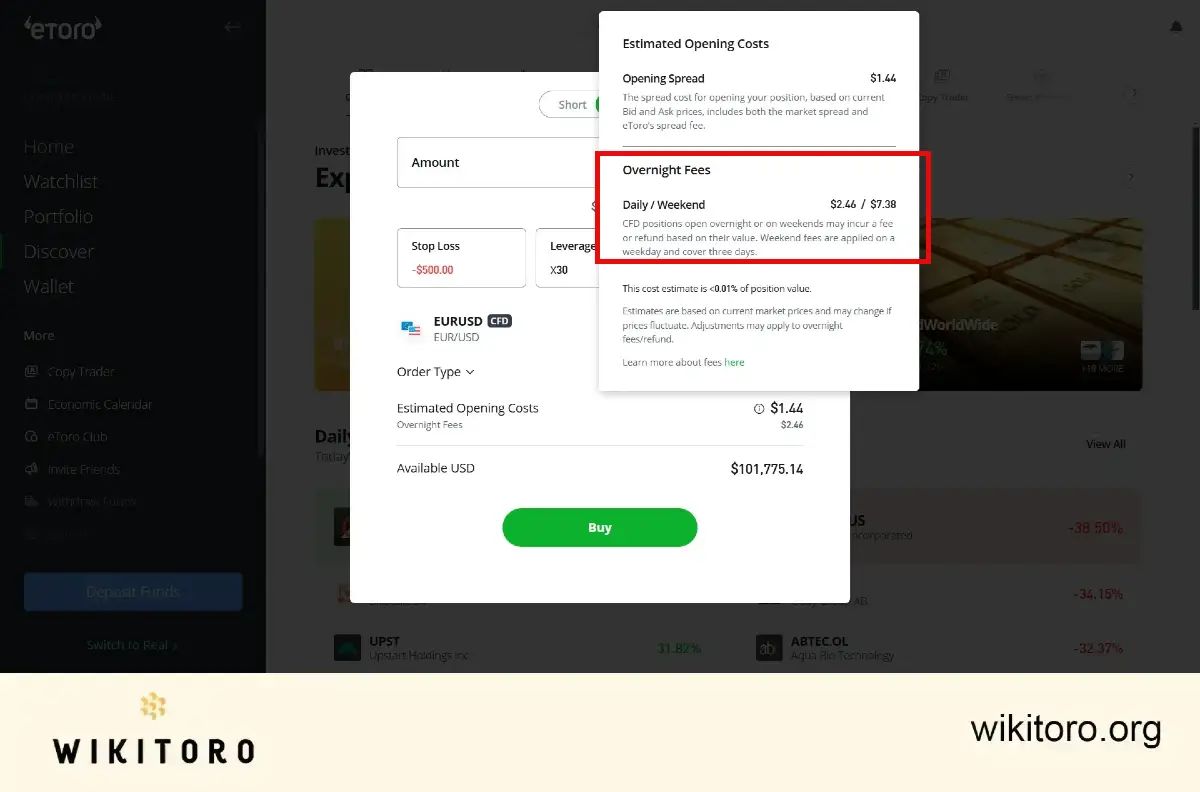

Holding a leveraged or short CFD position? You’ll pay an overnight fee for that privilege.

When it’s charged: Every weekday at 21:00 GMT (22:00 during Daylight Saving Time), Monday to Friday.

Weekend multiplier: To cover the weekend, eToro applies a triple fee once a week—on different days for different assets:

Trading Bitcoin, Ethereum, or anything else under the crypto banner? This will incur a fee.

What it costs: 1% fee when you buy or sell.

Where it shows up: It’s baked right into the price you see when opening or closing a trade. No surprises but just part of the deal.

Stocks and ETFs are mostly commission-free on eToro. Mostly.

Zero commission: Free trading in specific regions but not everywhere:

If you’re in Australia, Denmark, Finland, the Netherlands, Norway, Portugal, Spain, or Sweden:

Go dark for too long and eToro charges you for it.

How much: $10/month after 12 months of no activity.

How to avoid it: Just log in. Seriously. That alone resets the inactivity timer.

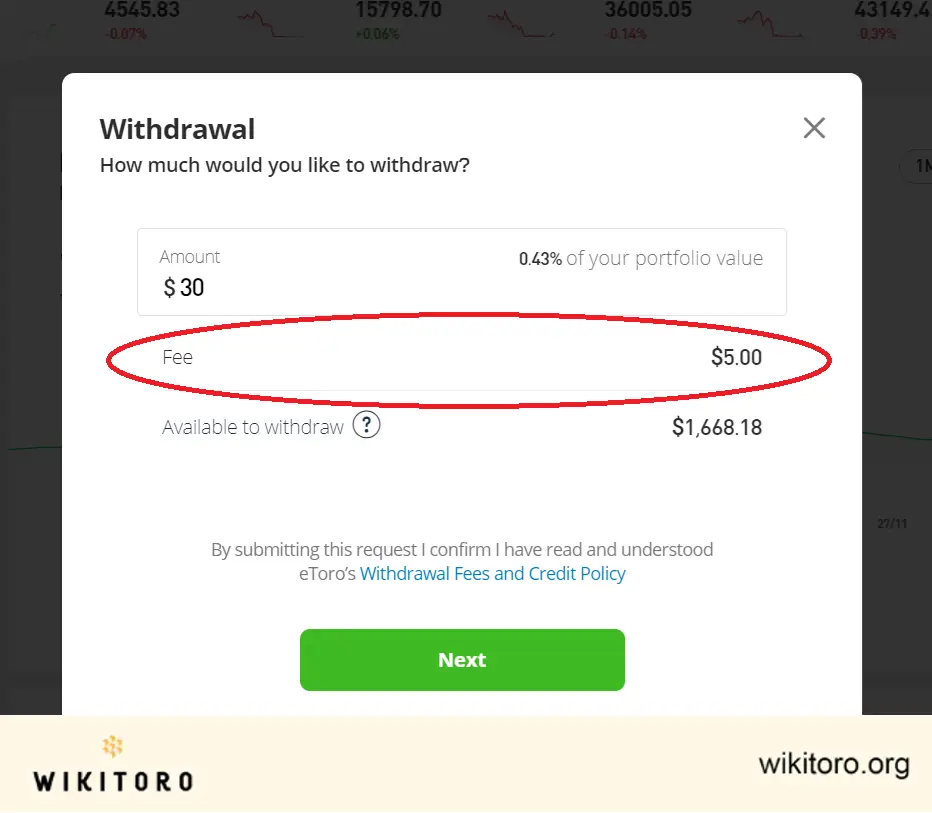

Pulling money out or depositing in a non-USD currency? Here’s what to expect:

Get a handle on these fees and I do believe that you’ll be able manage your eToro investments a lot more efficiently. Just pay close attention to when and how you trade. This could save you from racking up costs you didn’t plan for.

About Mike Druttman

About Mike Druttman