eToro's Fees for CFD Trading

- No deposit fees

- No account management fees

- No fees to open an account

- Commission-free for real stocks and ETF trading

- Transparent fee structure

61% of retail investor accounts lose money

When trading CFDs on eToro, two standard fees to watch out for are the spread and overnight (swap) fees.

Not sure what these costs mean? Let me break it down for you in detail:

Every CFD trade on eToro includes a spread—the difference between an asset’s buy (ask) and sell (bid) price. Think of it as the that's fee baked into each trade.

For example:

But keep in mind—spreads aren’t static. Market conditions, volatility, and asset type all play a part in how wide they get.

Hold a CFD position past 21:00 GMT (22:00 during Daylight Saving Time), and overnight fees (swap fees) kick in. This charge accounts for the leveraged funds used to maintain the position.

Now, here’s the kicker: for some assets, eToro applies a triple overnight fee on specific days:

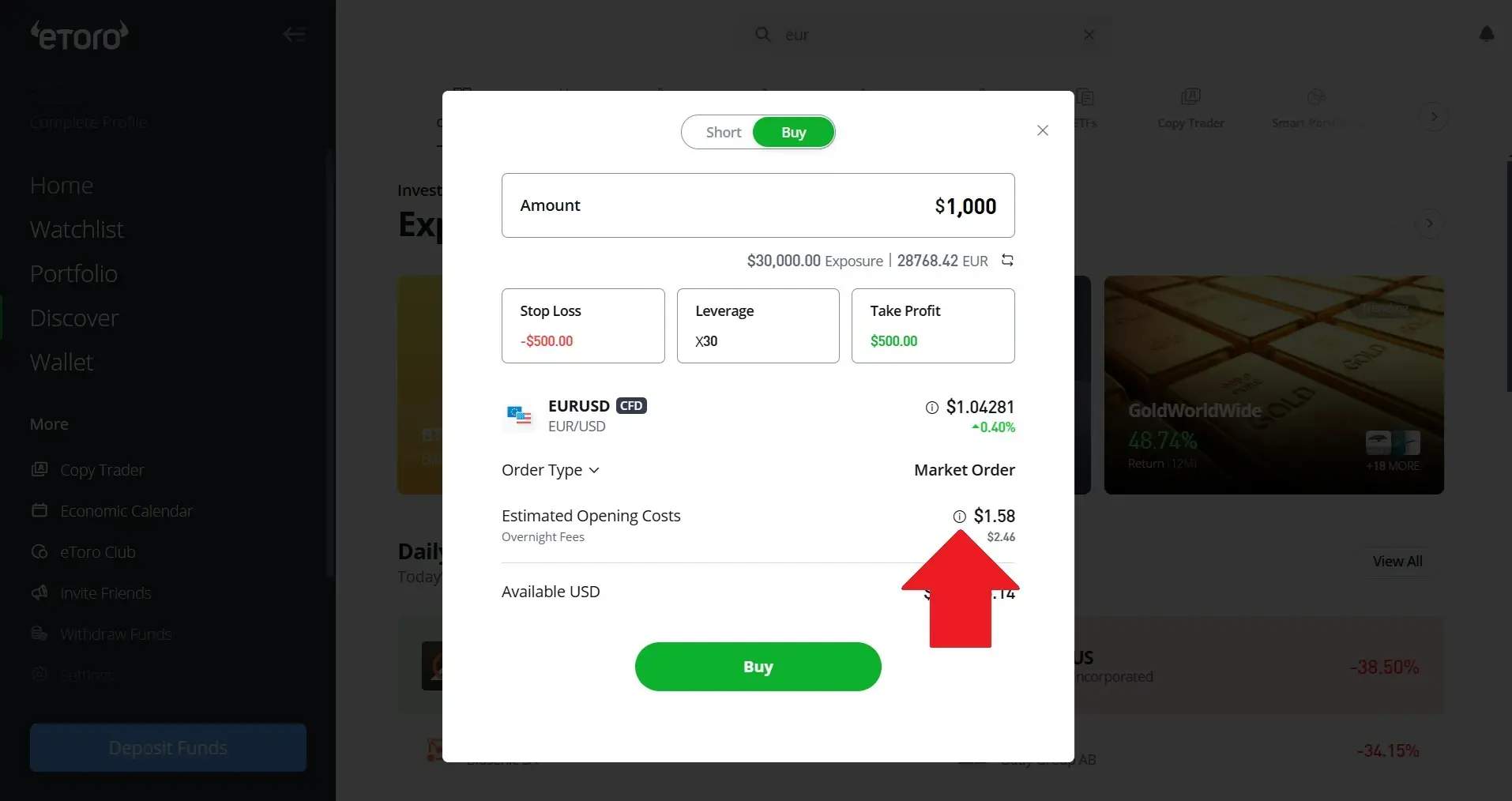

So how much are you paying exactly? The fee varies per asset, but eToro shows the exact amount in the ‘Open Trade’ window before you confirm your order.

You can view them by looking for the "i" icon beside the "Estimated Opening Costs" section.

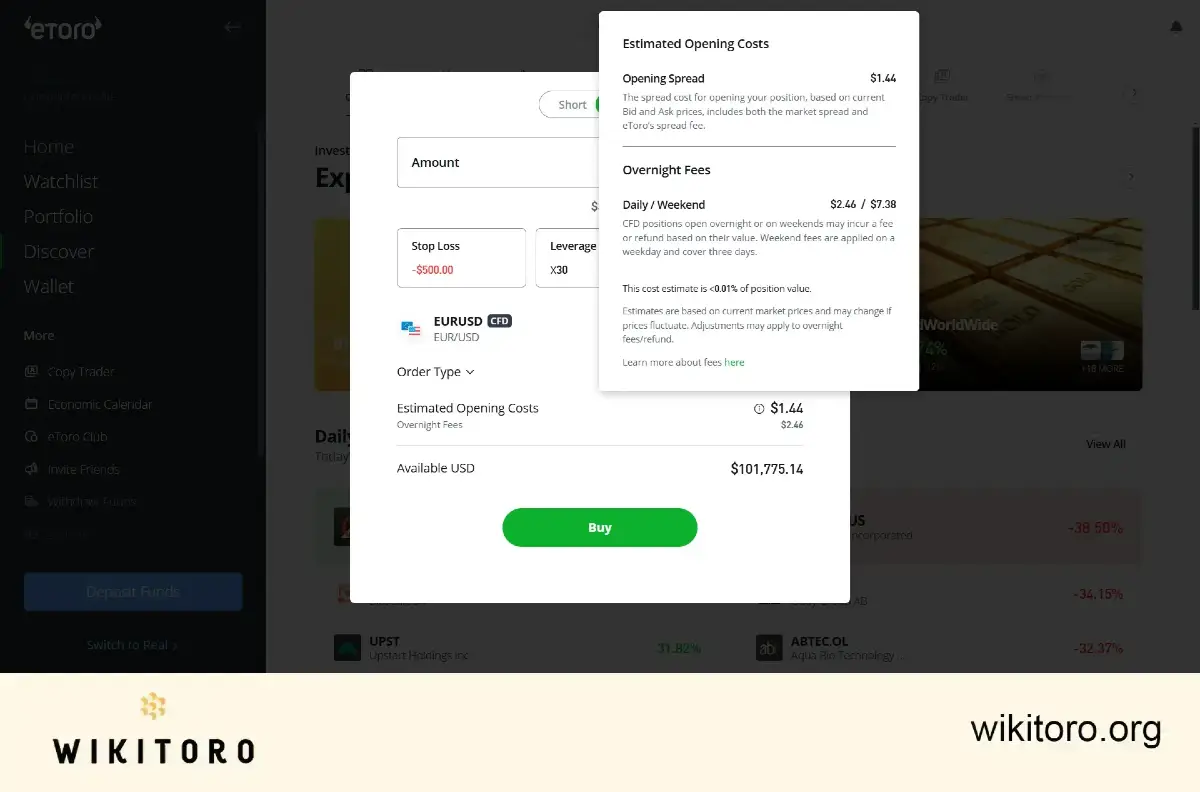

Click on this icon, and a small pop-up will appear with all the information about the spreads and overnight fees. Below is a screenshot that I took when trading the EURUSD currency pair. You can see the opening spread at $1.44 and the overnight fees at $2.46 and $7.38 for daily and weekend rates, respectively.

Just to be clear: these aren't hidden fees!

You see, these fees are upfront and are clearly stated on the platform and it's terms and conditions. No hidden fees or whatsoever.

You just need to be aware of them for you to make smarter trading decisions. So make sure to keep them in mind and you’ll be able to handle these CFD-related costs without any suprises.

About Mike Druttman

About Mike Druttman