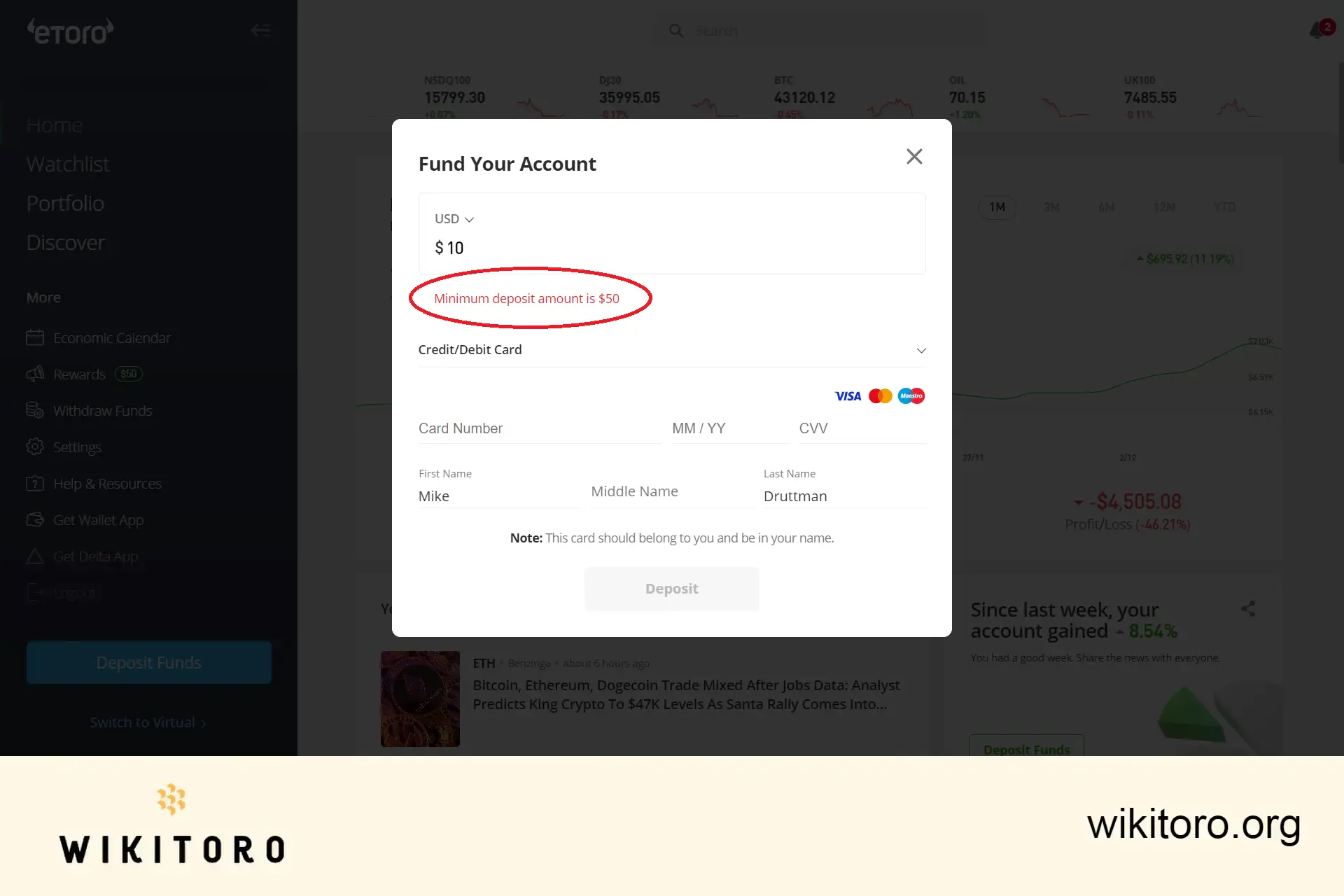

Signing up for an eToro account is free and there are no hidden setup costs. But if you want to actually start trading, you’ll need to make a deposit. For US and UK residents, the minimum first deposit is $50.

Your first deposit amount depends on where you’re located. For many regions and countries (including the US and UK), the initial deposit is $50, and the same goes for future top-ups.

Keep in mind: Some countries may require a higher amount to get started. So, check your local requirements before funding your account.

Need some info about the fees? Let’s get into the real numbers:

| Fee | Description |

| Spreads | This is the gap between the buy and sell price of an asset. eToro’s spreads vary depending on what you’re trading. For major forex pairs like EUR/USD or USD/JPY, spreads typically start from 1 pip. |

| Stock Trading Fees | Want to invest in stocks? You’ll usually pay a flat commission, either $1 or $2, depending on where you live and which exchange you're trading on. |

| Withdrawal Fee | eToro charges a $5 flat fee per withdrawal. Doesn’t matter if you’re taking out $100 or $10,000. |

| Currency Conversion | Since your account is in USD, deposits or withdrawals in another currency will trigger a conversion fee. The percentage varies based on the payment method and currency used. |

| Inactivity Fee | Don’t ghost your account. If there’s no login activity for 12 straight months, you’ll be charged $10 per month until you log back in or run out of balance. |

Also a heads up

eToro’s fees and terms can differ depending on your country. To avoid surprises, I recommend that you double-check the details directly on eToro’s official website or reach out to their support team for region-specific info about opening an eToro trading account.

About Mike Druttman

About Mike Druttman